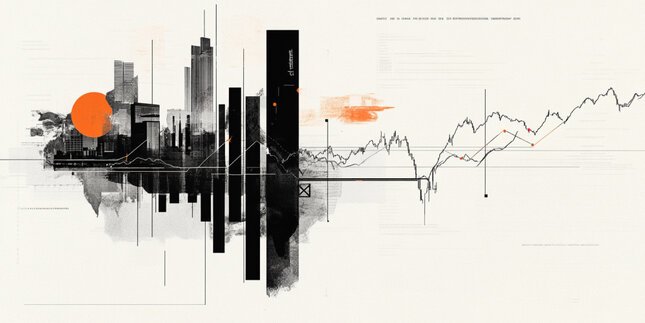

Short-term Elliott wave forecast for the Nasdaq 100 ETF (QQQ) suggests that the cycle from the April 2025 low is still active. Wave (4) of the continuation impulse ended at 580.27, and since then the ETF has resumed its upward trajectory. To confirm the continuation, the price must break above the high of the previous wave (3) recorded on October 30 at 638.41. The rally from the bottom of wave (4) of November 21 has matured and is expected to complete soon, reflecting the natural rhythm of the Elliott wave sequence.

The advance from wave (4) is detected as a five-wave impulse. Within this structure, wave ((i)) ended at 586.25, followed by a corrective pullback in wave ((ii)) that ended at 580.36. From there, the ETFs nested at higher levels. Wave (i) of the next series ended at 596.98, while wave (ii) fell to 589.44. Momentum carried wave (iii) to 606.76, before wave (iv) corrected to 597.32. The last leg, wave (v), reached 619.51, completing wave ((iii)) to a higher degree. The subsequent decline in wave ((iv)) ended at 612.13.

Looking ahead, wave ((v)) of 1 is expected to end soon. After that, corrective wave 2 should unfold, processing the cycle starting from the November 21 low before the ETFs resume their rally. In the near term, as long as the pivot at 580.27 remains intact, declines are expected to find support in a sequence of 3, 7 or 11, enhancing the prospects for further upside.

Nasdaq 100 ETF (QQQ) 30-Minute Elliott Wave Chart from 12.5.2025

Nasdaq 100 ETF Elliott Wave [Video]