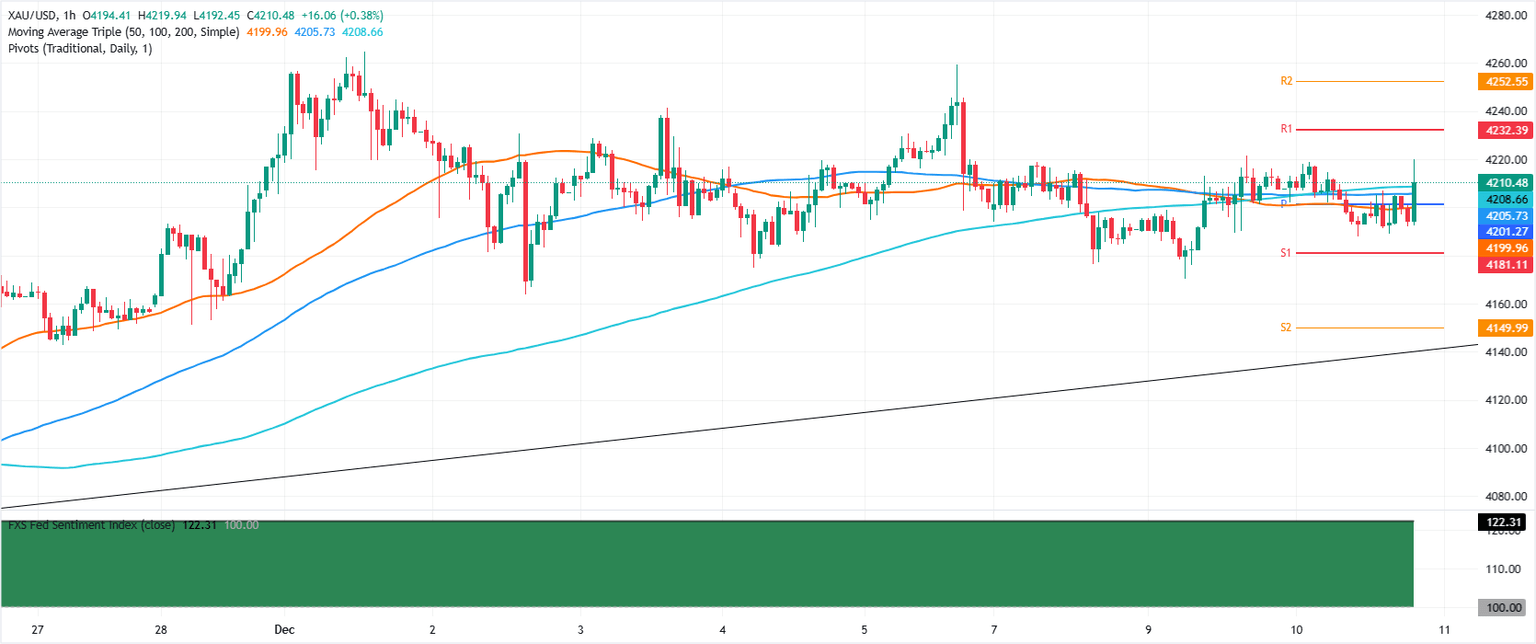

Gold prices (XAU/USD) rose on Wednesday after the Federal Reserve Bank (Fed) decided to cut interest rates, as expected. At the time of writing, the XAU/USD pair was trading volatile, between $4,190 – $4,220, registering losses of over 0.25%.

An interest rate cut by the Federal Reserve sparks volatility, sending gold prices to daily highs

On Wednesday, the Fed cut interest rates to 3.50%-3.75% as expected and kept the door open for just one rate cut in 2026. The Federal Open Market Committee (FOMC) vote was 9-3, with Governor Meiran voting in favor of a 50 basis point cut, while Jeffrey Schmid and Austin Goolsbee voted in favor of keeping interest rates unchanged.

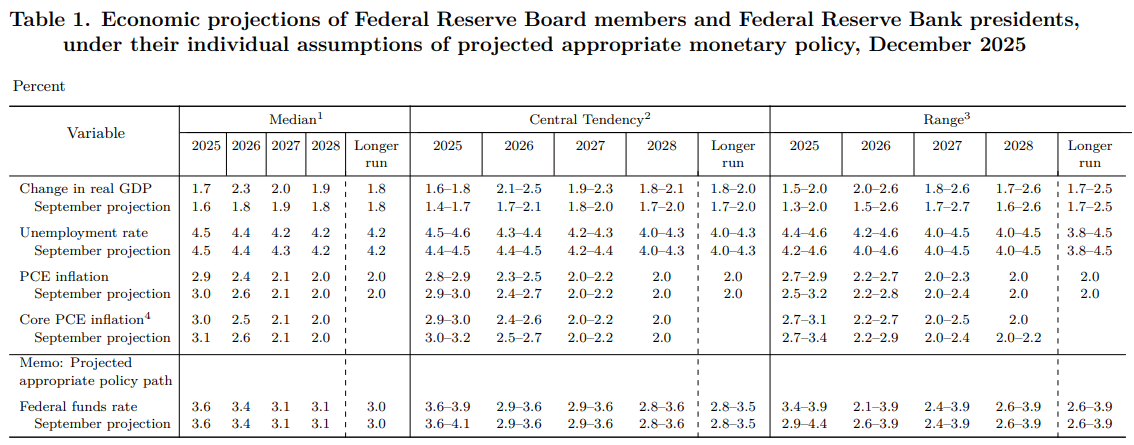

The Summary of Economic Expectations (SEP) showed that most members hinted that next year’s federal funds rates will be around 3.4%, meaning policymakers may cut 25 basis points next year. In the long term beyond 2028, Fed policymakers see interest rates as neutral at around 3%.

Highlights of the monetary policy statement

“Job gains have slowed this year, and the unemployment rate rose through September. More recent indicators are consistent with these developments. Inflation has been rising since earlier in the year and remains fairly high,” the Fed said in the statement.

They added, “The committee is concerned with the risks to both sides of its dual mandate and believes that the downside risks to employment have increased in recent months.”

Gold price reaction – hourly chart

Initially, the XAU/USD pair headed south, but as the decision was pessimistic, gold started to rise, hitting a daily high of $4,219.

Federal Reserve Bank Questions and Answers

Monetary policy in the United States is shaped by the Federal Reserve Bank (Fed). The Federal Reserve has two missions: achieving price stability and promoting full employment. The primary tool for achieving these goals is adjusting interest rates. When prices rise too quickly and inflation is above the Fed’s 2% target, it raises interest rates, which increases borrowing costs throughout the economy. This causes the US dollar (USD) to strengthen because it makes the United States a more attractive place for international investors to park their money. When inflation falls below 2% or when the unemployment rate is very high, the Fed may lower interest rates to encourage borrowing, which affects the dollar.

The Federal Reserve (Fed) holds eight policy meetings annually, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC meeting is attended by twelve Fed officials – the seven members of the Board of Governors, the New York Fed president, and four of the remaining eleven regional Fed presidents, who serve one-year terms on a rotating basis.

In extreme cases, the Fed may resort to a policy called quantitative easing (QE). Quantitative easing is the process by which the Federal Reserve dramatically increases the flow of credit into a stuck financial system. It is a non-standard policy measure used during crises or when inflation is very low. It was the Fed’s weapon of choice during the Great Financial Crisis of 2008. It involves the Fed printing more dollars and using them to buy high-quality bonds from financial institutions. Quantitative easing usually weakens the US dollar.

Quantitative tightening (QT) is the reverse process of quantitative easing, where the Fed stops purchasing bonds from financial institutions and does not reinvest capital from bonds it holds outstanding, to purchase new bonds. This is usually positive for the value of the US dollar.