The British pound rose 0.16% to approach 1.3320 against the US dollar during the European trading session on Wednesday. GBP/USD rises as the US dollar falls slightly amid caution ahead of the Federal Reserve’s monetary policy announcement at 19:00 GMT.

At the time of writing, the US Dollar Index (DXY), which measures the value of the US currency against six major currencies, was down 0.1% around 99.10.

The US dollar has come under pressure as the Fed is almost certain to cut interest rates by 25 basis points to 3.50%-3.75%. According to the CME FedWatch tool, the probability that the Fed will cut interest rates at this meeting is 87.6%. This will be the third rate cut by the Fed in a row.

The Fed’s dovish outlook is based on concerns about the US labor market, which has shown signs of weak job growth in the past few months. At the October monetary policy meeting, Fed Chairman Jerome Powell also acknowledged that “labor demand has clearly declined.” However, he argued strongly against cutting rates at the last meeting of 2026. “A cut in December is not a certainty, far from it,” Powell said.

In late November, New York Fed President John Williams also warned of downside employment risks, but shared a contrasting view with Powell, noting that there was room for further rate cuts because policy remained moderately restrictive.

Investors will also focus on the Fed’s monetary policy statement and Chairman Powell’s press conference on Wednesday for new signals on the outlook for monetary policy.

The Fed is unlikely to endorse an aggressive stance of easing monetary policy, as inflation has remained well above the 2% target for a long time.

Daily summary of market drivers: Sterling rises as Bank of England favors gradual policy easing

- The pound rose against its major counterparts on Wednesday as members of the interest rate-setting Bank of England (BoE) favored gradual removal of monetary policy restrictions over aggressive easing.

- On Tuesday, both Deputy Governors of the Bank of England, Claire Lombardelli and Dave Ramsden, backed a moderate monetary easing cycle, noting that risks to inflation remain to the upside.

- “I’m more concerned about the upside risks to inflation,” Lombardelli said, adding that she was less convinced than other members about “how restrictive monetary policy is right now, as in how far we are from reaching the end of the tapering cycle” before the Treasury Select Committee on Tuesday, the Wall Street Journal (WSJ) reported.

- Separately, the Bank of England’s Ramsden said that “a gradual removal of policy restrictions remains appropriate” because it would allow the Monetary Policy Committee (MPC) to carefully assess the “balance of risks to inflation” as evidence develops, Reuters reported.

- In its next monetary policy announcement next week, the Bank of England is expected to cut interest rates by 25 basis points to 3.50%-3.75%.

- For further signals on the Bank of England’s monetary policy, investors will focus on Governor Andrew Bailey’s comments in a pre-recorded friendly conversation on financial stability at the Financial Times (FT) Global Governing Council conference in London on Wednesday.

- On the fiscal front, British Treasury Secretary Rachel Reeves said during Wednesday’s European trading session that she could rule out capital gains tax on primary residences in this Parliament.

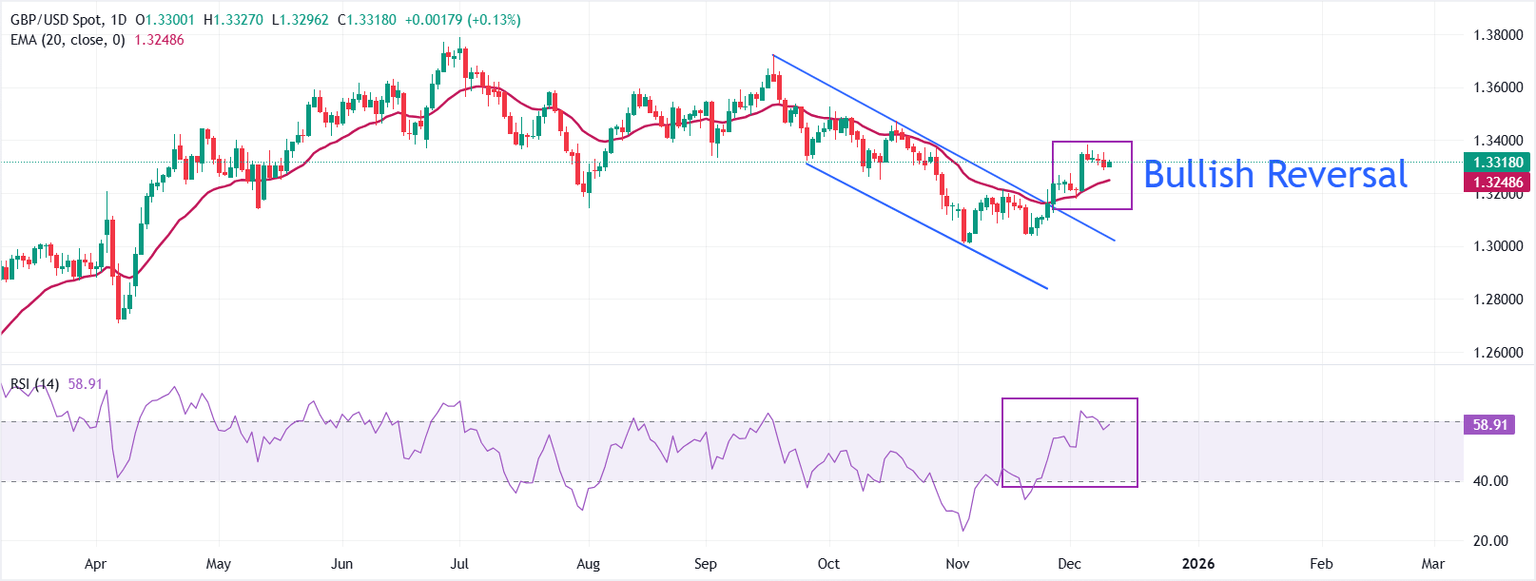

Technical Analysis: GBP/USD remains above the 20-day EMA

On the daily chart, the GBP/USD pair is trading at 1.3318. The price holds above the bullish 20-day EMA at 1.3249, keeping the short-term uptrend intact. The average has turned higher in recent sessions, and dips will find dynamic support near this measure. The downtrend line from 1.3726, September 17 high, was broken at 1.3026, removing overhead pressure and strengthening the bullish bias.

The Relative Strength Index (RSI) stands at 58.9 above the 50 level and is rising, confirming the bullish momentum without risks of overbought. If the pair maintains its momentum above the 20-day EMA at 1.3249, the bulls may extend the rally, while failure to do so would reveal a bounce towards the broken downtrend line around 1.3026.

(Technical analysis of this story was written with the help of an artificial intelligence tool)

Frequently asked questions for central banks

Central banks have the main task of ensuring that prices in a country or region are stable. Economies constantly experience inflation or deflation when the prices of certain goods and services fluctuate. A continuous rise in prices for the same goods means inflation, and a continuous fall in prices for the same goods means deflation. It is the responsibility of the central bank to maintain demand by adjusting the interest rate. For the largest central banks such as the US Federal Reserve (Fed), the European Central Bank (ECB), or the Bank of England (BoE), the mandate is to keep inflation near 2%.

The central bank has one important tool at its disposal to raise or lower inflation, and that is by adjusting its benchmark interest rate, known as the interest rate. At the moments announced in advance, the central bank will issue a statement on its interest rate and provide additional reasons as to why it will remain or change (lower or raise). Local banks will adjust their savings and lending rates accordingly, which will make it harder or easier for people to earn their savings or for companies to get loans and make investments in their businesses. When a central bank raises interest rates significantly, this is called monetary tightening. When the benchmark interest rate is lowered, it is called monetary easing.

The central bank is often politically independent. Members of the central bank’s policy board go through a series of committees and hearings before being appointed to a policy board seat. Each member of this board often has a certain conviction about how the central bank should control inflation and subsequent monetary policy. Members who want very loose monetary policy, with low interest rates and cheap lending, to boost the economy significantly while being content to see inflation just above 2%, are called “doves.” Members who want to see higher interest rates to reward savings and want to keep inflation down at all times are called “hawks” and will not rest until inflation reaches 2% or just below.

Typically, there is a chair or chair who presides over each meeting, needs to create consensus among the hawks or doves, and has the final say when it comes to dividing the votes to avoid a 50-50 tie on whether the current policy should be amended. The Chairman will often make live follow-up speeches, communicating the current cash position and outlook. The central bank will try to push its monetary policy forward without causing violent fluctuations in interest rates, stocks, or its currency. All central bank members will direct their stance towards the markets before the policy meeting. A few days before the policy meeting and until the new policy is announced, members are prohibited from speaking publicly. This is called a blackout period.