Gold (XAU/USD) continues its sideways price action during the early European session and is trading just below the weekly high touched earlier this Wednesday. The US dollar (USD) fell to a new low since late October amid growing bets on further interest rate cuts by the Federal Reserve (Fed). This, coupled with cautious market mood and geopolitical uncertainties, turned out to be other factors acting as tailwinds for precious metals.

However, XAU/USD bulls seem hesitant to place aggressive bets and are choosing to wait for the results of the two-day FOMC meeting. The main focus will be on the updated economic forecasts and Fed Chairman Jerome Powell’s speech, in which signals will be looked for on the path of future interest rate cuts. This in turn will push the US dollar and non-yielding gold, calling for caution before taking positions to extend an overnight rebound from a week’s low.

Daily Summary Market Movers: Gold traders are waiting for interest rate cuts by the Fed before placing directional bets

- The US Federal Reserve is scheduled to announce its decision at the end of its two-day policy meeting later on Wednesday, and is widely expected to cut interest rates by 25 basis points despite steady inflation.

- Indeed, the US Commerce Department reported last Friday that inflation, as measured by the Personal Consumer Expenditure Price Index, remained above the annual target of 2% set by the Federal Reserve in September.

- However, Fed officials see slow hiring, modest economic growth, and weak wage gains as likely to moderate inflation in the coming months, supporting the case for further policy easing by the central bank.

- The outlook appeared to be unaffected by the upbeat US Jobs and Labor Turnover (JOLTS) report released on Tuesday, which pointed to continued demand for workers and labor market resilience.

- The monthly JOLTS report issued by the Department of Labor showed that the number of job vacancies on the last working day of September rose sharply to 7.658 million, while in October it reached 7.67 million.

- Meanwhile, the US dollar is struggling to capitalize on its recent upward move seen in the past week or so amid a dovish Fed outlook, offering some support to non-yielding gold on Wednesday.

- President Volodymyr Zelensky said Monday that Ukraine will not cede territory to Russia and accept painful concessions to end the war. This also provides support for the precious metal which is considered a safe haven.

- Traders are waiting for more signals on the path of the Fed’s interest rate cuts before placing new directional bets. Hence, the focus will be on the updated economic forecasts and Fed Chairman Jerome Powell’s press conference.

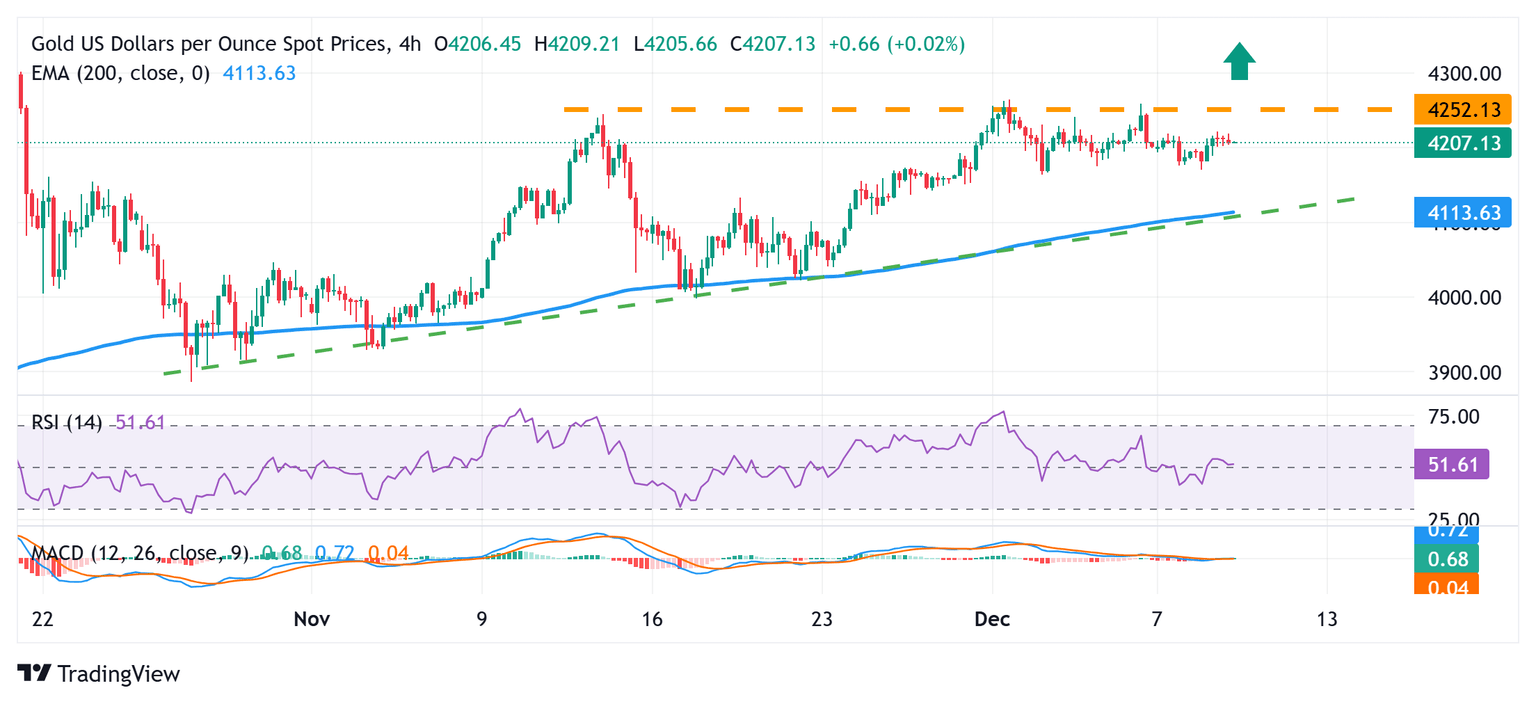

Gold is still confined to a familiar range; The downside possibilities appear limited

The XAU/USD pair has been oscillating in a familiar range for the past two weeks or so. Moreover, the overnight bounce from the vicinity of the trading range support and subsequent move higher favors bullish traders. However, neutral oscillators on the daily chart make it wise to wait for sustained strength above the $4245-4250 barrier before entering into positions for further gains. The momentum could then lift gold price to the medium hurdle of $4,277-$4,278 on its way to the $4,300 level.

On the flip side, weakness below the round figure of $4,200 may continue to attract some buyers near the $4,170-4,165 area, or trading range support. A convincing break below could leave the gold price vulnerable to accelerating the decline towards a test of the confluence area at $4,115 – which includes an uptrend line extending from late October and the 200-period Exponential Moving Average (EMA) on the 4-hour chart. Some subsequent selling will be seen as a major catalyst for bearish traders and set the stage for deeper losses.

Economic indicator

Federal Open Market Committee press conference

The press conference lasts about an hour and consists of two parts. First: Chairman of the Committee Federal Reserve (Federal Reserve) reads a prepared statement, then the conference opens to questions from the press. Questions often lead to unwritten answers that lead to extreme market volatility. The Fed holds a news conference after all eight annual policy meetings.

Read more.

Next release:

Wednesday 10 December 2025 at 19:30

repetition:

irregular

consensus:

–

former:

–

source:

Federal Reserve