Gold (XAU/USD) starts the week on a flat footing, extending its fifth straight day of advance, as uncertainty over the Federal Reserve’s (Fed) monetary policy outlook keeps traders on the defensive. At the time of writing, the XAU/USD pair is trading at around $4,345, just below its all-time high near $4,381, which was recorded on October 20.

From a broader macro perspective, the metal remains supported by ongoing geopolitical tensions. Meanwhile, continued strong demand from central banks and strong flows into gold-backed exchange-traded funds provide a steady tailwind to prices.

Investors are also bracing for a busy US economic calendar in the coming days, with upcoming data likely to shape expectations about the Fed’s policy path through 2026. The spotlight this week is on the delayed non-farm payrolls (NFP) report for October and November, due on Tuesday, followed by the Consumer Price Index (CPI) on Thursday.

Market Drivers: Markets remain on the defensive amid China’s slowdown and dovish Fed signals

- China’s latest economic indicators highlighted a deepening slowdown in the world’s second-largest economy, with industrial production in November expanding 4.8% year-on-year, below expectations and slightly slower than October, while retail sales rose just 1.3%, marking their weakest gain since late 2022. The weak data reinforced concerns about global growth, supported risk-off sentiment and supported safe-haven gold demand.

- Geopolitical tensions remain high amid stalled US-led peace talks between Russia and Ukraine. Reuters reported that Ukrainian President Volodymyr Zelensky offered to abandon Ukraine’s efforts to join NATO in exchange for Western security guarantees, as part of efforts to end the war with Russia. This proposal would meet one of Moscow’s main war goals, although Kiev has so far stuck to its position of refusing to cede territory to Russia.

- The Fed cut borrowing costs by 25 basis points last week by a 9-3 vote, raising interest rates to a range of 3.50% to 3.75%, and signaled a “wait-and-see” approach for further easing as policymakers balance persistent labor market weakness with inflation that remains steady.

- In the press conference following the meeting, Fed Chairman Jerome Powell said the central bank was “well positioned to wait and see how the economy develops,” while acknowledging risks on both sides of the Fed’s dual mandate. The relatively less hawkish tone has traders pricing in two rate cuts next year, although the latest chart suggests only one cut.

- Two of the three opponents, including Chicago Fed President Austin Goolsbee and Kansas City Fed President Jeffrey Schmid, favored leaving interest rates unchanged. Goolsbee said on Friday he would prefer to wait for more clarity on inflation before easing further, while Schmid said not much has changed since the previous meeting, stressing that inflation remains very high and the economy is still showing momentum with a cool but largely balanced labor market.

- Looking ahead, the US economic calendar is light on Monday, with the New York Empire State Manufacturing Index released. Markets will also analyze comments from Fed Governor Stephen Meiran, who dissented in favor of a further 50 basis point rate cut, along with comments from New York Fed President John Williams later in the day.

Technical Analysis: Bulls are looking to break the $4,350 level

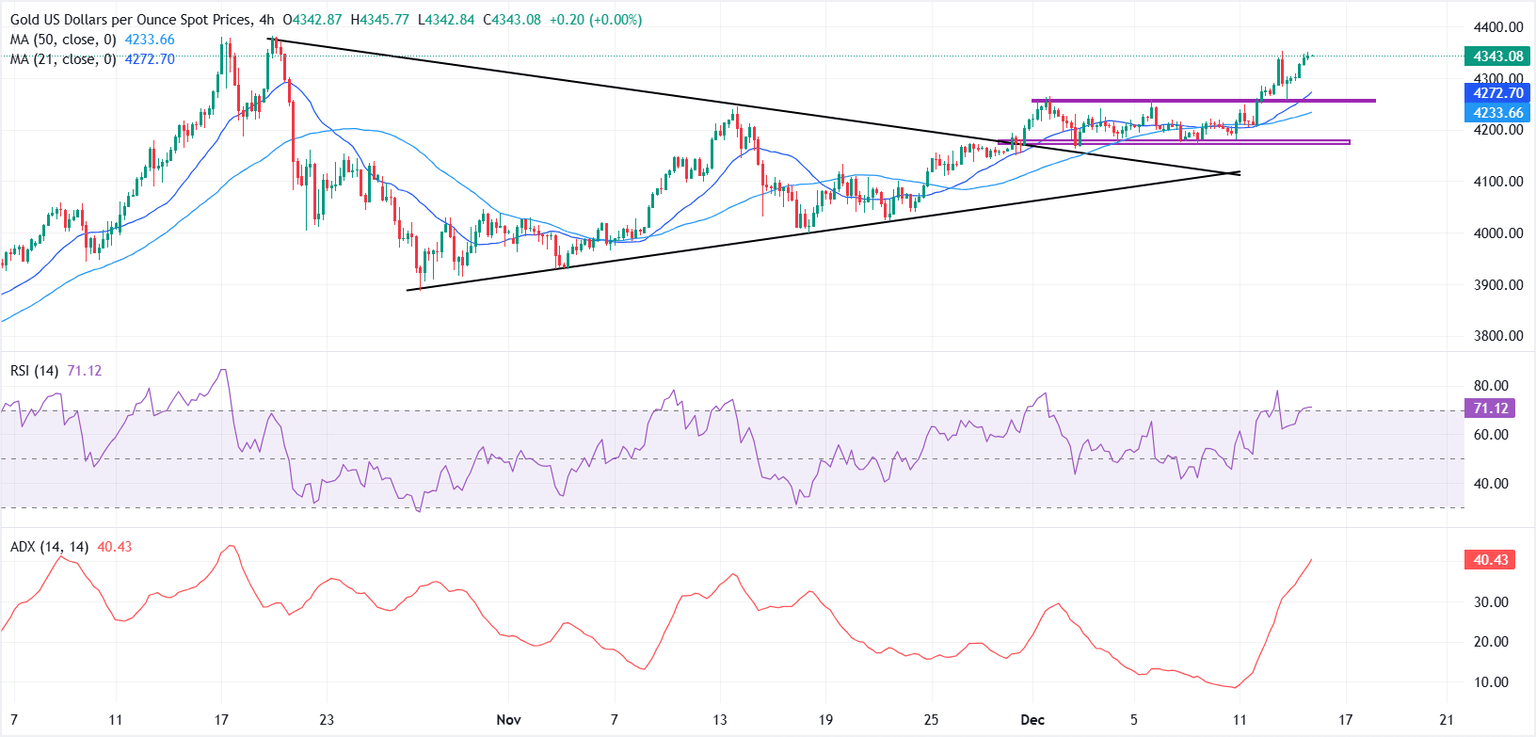

From a technical perspective, the broader structure of gold remains constructive after a sustained upward move above the symmetrical triangle pattern. On the upside, immediate resistance emerges near the $4,350 level, before a potential retest of the all-time high near $4,381.

On the downside, the previous breakout zone near $4,250 now acts as major initial support, followed by the 50-period simple moving average (SMA) at $4,233. A deeper corrective pullback could attract fresh buying interest in the $4180-$4170 area.

Momentum indicators are also supporting the uptrend, with the Relative Strength Index (RSI) holding above 70, indicating strong upward momentum, while the Average Directional Index (ADX) at 40 has turned sharply higher, indicating strengthening trend conditions.

Frequently asked questions about gold

Gold has played a major role in human history as it has been widely used as a store of value and a medium of exchange. Currently, apart from its luster and use in jewellery, the precious metal is widely viewed as a safe haven asset, meaning it is a good investment during turbulent times. Gold is also widely viewed as a hedge against inflation and currency depreciation because it is not dependent on any specific issuer or government.

Central banks are the largest holders of gold. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and purchase gold to improve the perceived strength of the economy and the currency. High gold reserves can be a source of confidence for a country’s solvency. Central banks added 1,136 tons of gold worth about $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest annual purchase since records began. Central banks in emerging economies such as China, India and Turkey are rapidly increasing their gold reserves.

Gold has an inverse relationship with the US dollar and US Treasuries, which are major reserve assets and safe havens. When the value of the dollar declines, gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rise in the stock market tends to weaken the price of gold, while a sell-off in riskier markets tends to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession could cause the price of gold to rise rapidly due to its safe-haven status. As a lower-yielding asset, gold tends to rise as interest rates fall, while a higher cost of money usually negatively impacts the yellow metal. However, most of the moves depend on how the US Dollar (USD) behaves as the asset is priced in Dollars (XAU/USD). A stronger dollar tends to keep the price of gold in check, while a weaker dollar is likely to push gold prices higher.