The Japanese Yen (JPY) held on to its intraday gains during the early European session on Monday and appears poised to rise further amid the Bank of Japan’s hawkish outlook. Against the backdrop of the recent shift in BOJ Governor Kazuo Ueda’s rhetoric, the improvement in business confidence reaffirms market bets on an imminent interest rate hike this week. Apart from this, the slight deterioration in global risk sentiment has turned out to be another factor supporting the safe haven status of the Japanese yen.

The above-mentioned supportive factors have largely offset concerns about Japan’s deteriorating fiscal situation on the back of Prime Minister Sanae Takaishi’s massive spending plan. On the other hand, the US dollar is near its lowest level in two months, which it touched last Thursday, amid increasing bets on two additional interest rate cuts by the Federal Reserve. This represents a significant contrast from the Bank of Japan’s hawkish outlook, which in turn validates the positive near-term outlook for the low-yielding Japanese yen.

The Japanese yen is supported by the Bank of Japan’s hawkish bets and safe haven flows

- According to the Bank of Japan’s quarterly Tankan survey released earlier Monday, the business confidence index of major manufacturers in Japan rose to 15 in the fourth quarter of 2025 from 14.0 in the previous quarter. Further details revealed that large manufacturing expectations reached 15.0 versus 12.0 previously.

- Commenting on the Tankan survey, a senior Bank of Japan official said Japanese companies cited easing uncertainty over US trade policy and resilient demand in high-tech sectors as key factors supporting business sentiment. Companies cited cost pass-through and strong demand as factors brightening the business outlook.

- Moreover, Bank of Japan Governor Kazuo Ueda recently said that the central bank is close to achieving its inflation target. This reaffirms market bets on an imminent rate hike from the Bank of Japan at the end of the policy meeting scheduled for December 18-19 and supports the case for further policy tightening through 2026.

- Furthermore, reports indicate that senior officials in Prime Minister Sanae Takaishi’s government are unlikely to oppose a rate hike from the Bank of Japan. However, traders appear reluctant to place bullish bets around the Japanese yen and are choosing to wait for more signals on the Bank of Japan’s future policy path before bracing for further gains.

- Therefore, the focus will remain on Ueda’s post-meeting press conference on Friday. Meanwhile, Takaishi’s massive spending plan has exacerbated concerns about Japan’s public finances amid slowing economic growth, which in turn is another factor acting as a headwind for the Japanese yen.

- On the other hand, the US dollar is struggling to attract any meaningful buyers and languishes near a two-month low reached last Thursday amid dovish expectations from the Federal Reserve. The Federal Reserve has signaled caution about further rate cuts, although traders expect two more rate cuts next year.

- Meanwhile, US President Donald Trump said he has narrowed the list of contenders to replace Jerome Powell as the next head of the Federal Reserve, and expects his nominee to deliver interest rate cuts. The prospect of a Fed Chairman allied with Trump keeps USD bulls on the defensive and limits USD/JPY.

- Traders also appear hesitant ahead of important US economic releases this week, including the delayed October non-farm payrolls (NFP) report on Tuesday and the latest inflation figures on Thursday. Meanwhile, divergent outlooks for the Bank of Japan and the Federal Reserve may continue to support the low-yielding Japanese yen.

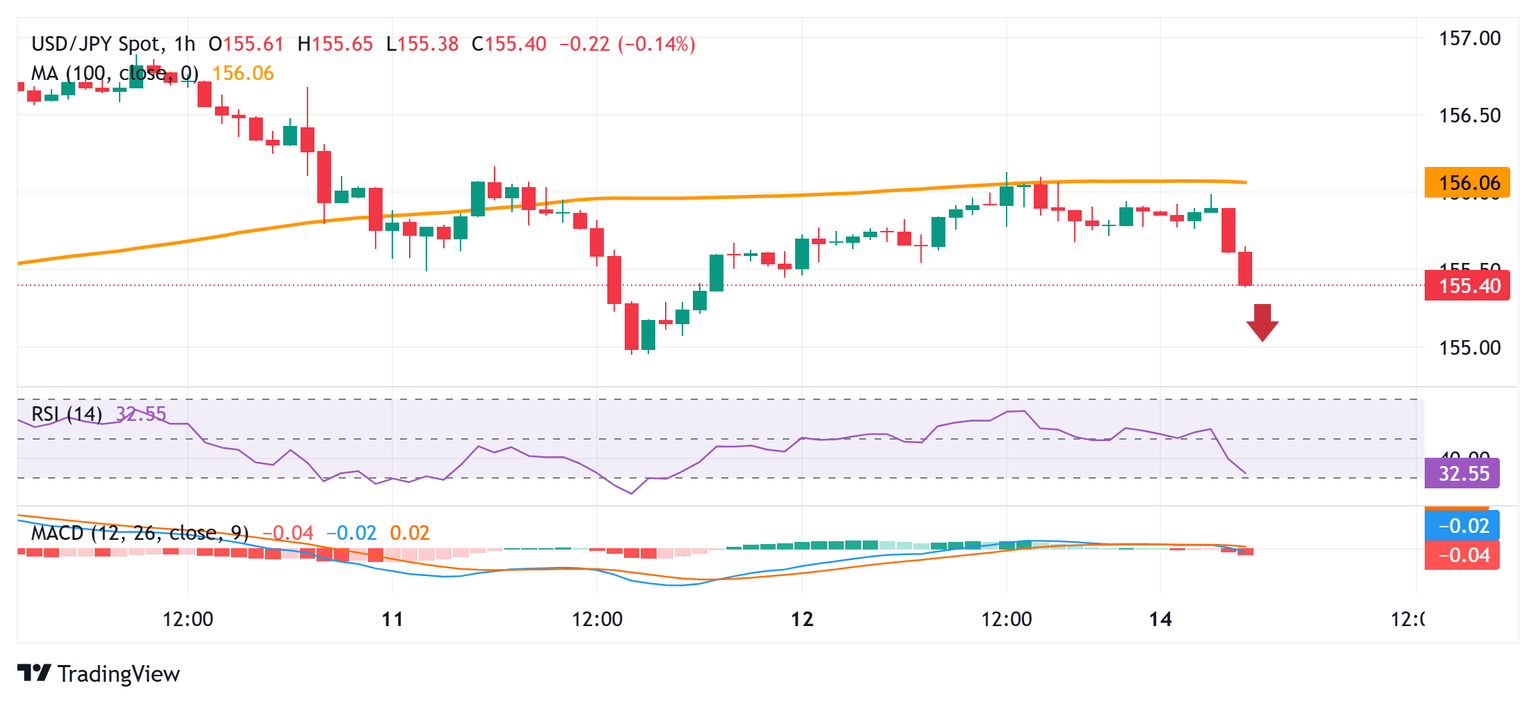

USD/JPY bears are now waiting for a break below 155.00 before placing new bets.

From a technical perspective, the USD/JPY pair is struggling to return above the 100 hourly simple moving average (SMA), and the subsequent decline favors bearish traders. However, positive oscillators on the daily chart suggest that any further decline is likely to find good support near the psychological level of 155.00. A convincing break below the latter would leave spot prices vulnerable to accelerating the decline towards a monthly low, around the 154.35 area, on its way to the 154.00 mark.

On the flip side, the 100 hourly simple moving average, currently pinned at the round figure of 156.00, may continue to act as an immediate hurdle. Some subsequent buying after Friday’s high, around the 156.10-156.15 area, could trigger a short covering move and lift USD/JPY to the 157.00 area. Sustained yet recent strength would pave the way for additional gains towards the 157.45 intermediate hurdle on the way to a multi-month high, around the 158.00 area, touched in November.

Economic indicator

The Bank of Japan’s interest rate decision

the Bank of Japan The Bank of Japan announces its interest rate decision after each of the bank’s eight scheduled annual meetings. In general, if the Bank of Japan is hawkish on the economy’s inflationary outlook and raises interest rates, it is bullish for the Japanese Yen (JPY). Likewise, if the Bank of Japan has a pessimistic view on the Japanese economy and keeps interest rates unchanged, or lowers them, this is usually a downtrend for the Japanese yen.

Read more.

Next release:

Friday 19 December 2025 at 03:00

repetition:

irregular

consensus:

–

former:

0.5%

source:

Bank of Japan