The price of gold (XAU/USD) rose above $4,350 during early European trading hours on Tuesday. The precious metal is regaining some ground after falling 4.5% in the previous session, which was gold’s biggest single-day loss since October. Increased margin requirements on gold and silver futures contracts by the Chicago Mercantile Exchange (CME) Group, one of the world’s largest commodity trading floors, led to widespread profit taking and portfolio rebalancing.

However, the yellow metal’s potential downside may be limited amid the possibility of a Fed rate cut in 2026. Lower interest rates may reduce the opportunity cost of holding gold, supporting the non-yielding precious metal. Moreover, continued global economic uncertainty and geopolitical tensions could boost traditional assets such as gold.

Trading volumes are expected to remain weak ahead of the New Year holiday. Traders are preparing for the release of the Federal Open Market Committee (FOMC) meeting minutes later Tuesday to gain fresh momentum.

Daily Summary Market Drivers: Gold rises amid bets of Fed rate cuts in 2026 and geopolitical turmoil

- Russia has accused Ukraine of launching a drone attack on the Russian presidential residence in northern Russia, prompting Moscow to reconsider its position in peace negotiations, Reuters reported on Monday. Ukraine rejected Russian statements about the drone attack, and its foreign minister said that Moscow was seeking “false justifications” for more strikes against its neighbor.

- The Chicago Mercantile Exchange raised margin requirements for gold, silver and other metals in a notice posted on the exchange’s website on Friday. These notices require traders to place more cash on their bets in order to insure against the possibility of the trader defaulting upon receipt of the contract.

- U.S. in-process home sales rose 3.3% month-over-month in November after an upwardly revised 2.4% rise in October, according to the National Association of Realtors on Monday. This figure was stronger than estimates of 1.0% and recorded its highest level since February 2023.

- US President Donald Trump said last week that he expects the next Fed chief to keep interest rates low and never “disagree” with him. These comments are likely to increase concerns among investors and policymakers about the independence of the Federal Reserve.

- Financial markets expect a roughly 16.1% chance that the Federal Reserve will cut interest rates at its next meeting in January, according to the CME FedWatch tool.

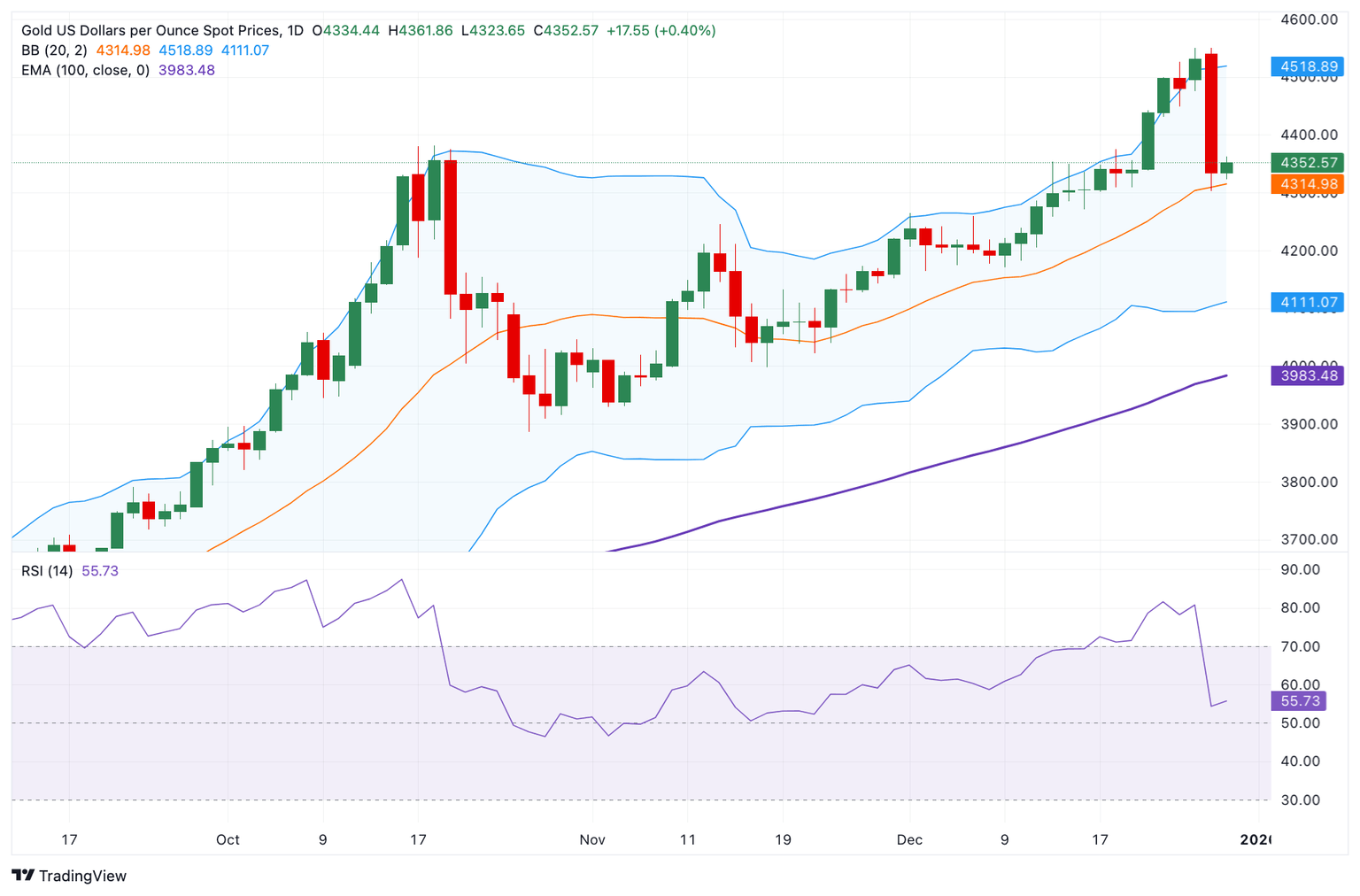

Gold maintains its bullish bias, and the RSI points to consolidation in the near term

Gold is trading positively during the day. A constructive outlook prevails for the precious metal as the price remains above the 100-day Exponential Moving Average (EMA) on the daily chart, while the Bollinger Band expands.

However, further consolidation or temporary selling cannot be ruled out as the 14-day RSI hovers around the midline. This indicates neutral near-term momentum.

The immediate resistance level to watch is the upper Bollinger band at $4,520. A decisive break above this level would likely lead to a retest of the all-time high at $4,550, on its way to the psychological level of $4,600.

On the other hand, the initial support level for the XAU/USD pair appears in the $4,305-$4,300 area, which represents the round and low figure of December 29. Any subsequent selling below the mentioned level will indicate that the correction has more room to run and could target the December 16 low at $4,271.

Frequently asked questions about gold

Gold has played a major role in human history as it has been widely used as a store of value and a medium of exchange. Currently, apart from its luster and use in jewellery, the precious metal is widely viewed as a safe haven asset, meaning it is a good investment during turbulent times. Gold is also widely viewed as a hedge against inflation and currency depreciation because it is not dependent on any specific issuer or government.

Central banks are the largest holders of gold. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and purchase gold to improve the perceived strength of the economy and the currency. High gold reserves can be a source of confidence for a country’s solvency. Central banks added 1,136 tons of gold worth about $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest annual purchase since records began. Central banks in emerging economies such as China, India and Turkey are rapidly increasing their gold reserves.

Gold has an inverse relationship with the US dollar and US Treasuries, which are major reserve assets and safe havens. When the value of the dollar declines, gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rise in the stock market tends to weaken the price of gold, while a sell-off in riskier markets tends to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession could cause the price of gold to rise rapidly due to its safe-haven status. As a lower-yielding asset, gold tends to rise as interest rates fall, while a higher cost of money usually negatively impacts the yellow metal. However, most of the moves depend on how the US Dollar (USD) behaves as the asset is priced in Dollars (XAU/USD). A stronger dollar tends to keep the price of gold in check, while a weaker dollar is likely to push gold prices higher.