The EUR/USD pair continues its losses during the European session on Friday, trading near 1.1720 heading into the US trading session, down from highs after 1.1800 in late December. Disappointing manufacturing activity numbers in the euro zone and some of its major economies added downward pressure on the euro, in a quiet session into the new year.

However, from a broader perspective, the pair is still a relatively short distance from the three-month highs of 1.1808 seen just before Christmas. The US dollar (USD) will depreciate by approximately 14% against the euro in 2025, affected by market concerns about US President Donald Trump’s erratic trade policies, signs of a slowdown in the US economy, and more recently also the monetary policy divergence between the European Central Bank (ECB) and the US Federal Reserve (Fed).

Final HCOB manufacturing PMI figures for Germany and the Eurozone highlight the declining contribution of manufacturing activity to the region’s GDP. Investors are now looking forward to the final release of the S&P Manufacturing PMI in the US, which may provide some new momentum for the dollar.

Euro price today

The table below shows the percentage change of the Euro (EUR) against the major currencies listed today. The euro was the strongest against the Japanese yen.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | 0.21% | 0.12% | -0.02% | -0.05% | -0.35% | -0.34% | -0.03% | |

| euro | -0.21% | -0.14% | -0.13% | -0.16% | -0.52% | -0.45% | -0.14% | |

| GBP | -0.12% | 0.14% | 0.00% | -0.06% | -0.38% | -0.31% | 0.00% | |

| JPY | 0.02% | 0.13% | 0.00% | -0.14% | -0.46% | -0.38% | -0.01% | |

| Canadian | 0.05% | 0.16% | 0.06% | 0.14% | -0.33% | -0.24% | 0.03% | |

| Australian dollar | 0.35% | 0.52% | 0.38% | 0.46% | 0.33% | 0.07% | 0.38% | |

| New Zealand dollar | 0.34% | 0.45% | 0.31% | 0.38% | 0.24% | -0.07% | 0.31% | |

| Swiss franc | 0.03% | 0.14% | -0.00% | 0.00% | -0.03% | -0.38% | -0.31% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select EUR from the left column and move along the horizontal line to USD, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Summary Market Drivers: Euro declines after weak manufacturing data

- The Euro is losing ground against its major counterparts on Friday, following a series of weaker-than-expected manufacturing activity numbers in Europe. The euro zone HCOB manufacturing PMI was revised down to 48.8 from a preliminary estimate of 49.2 in December, reflecting a faster contraction than the 49.6 reading seen in November and 50.0 in October.

- Likewise, Germany’s HCOB Manufacturing PMI showed weaker-than-expected activity, with December’s decline revised to 47.0, from an initial estimate of 47.7, and from a November reading of 48.2.

- Italy’s manufacturing PMI fell to 47.9 in December, from 50.6 in November, and Spain’s manufacturing activity fell to 49.6 from 51.5. A positive exception was France’s manufacturing PMI, which rose to 50.7 from 50.6 in November.

- Later on Friday, focus will shift to the US S&P Global Manufacturing PMI, whose preliminary reading showed a slowdown to 51.8 in December from 52.2 in November. These numbers are consistent with moderate growth in business activity.

- However, investors will likely be interested in the release of the US non-farm payrolls report, due at the end of next week, and the name of the person who will replace Chairman Jerome Powell at the Fed, which is expected to be revealed in the coming weeks.

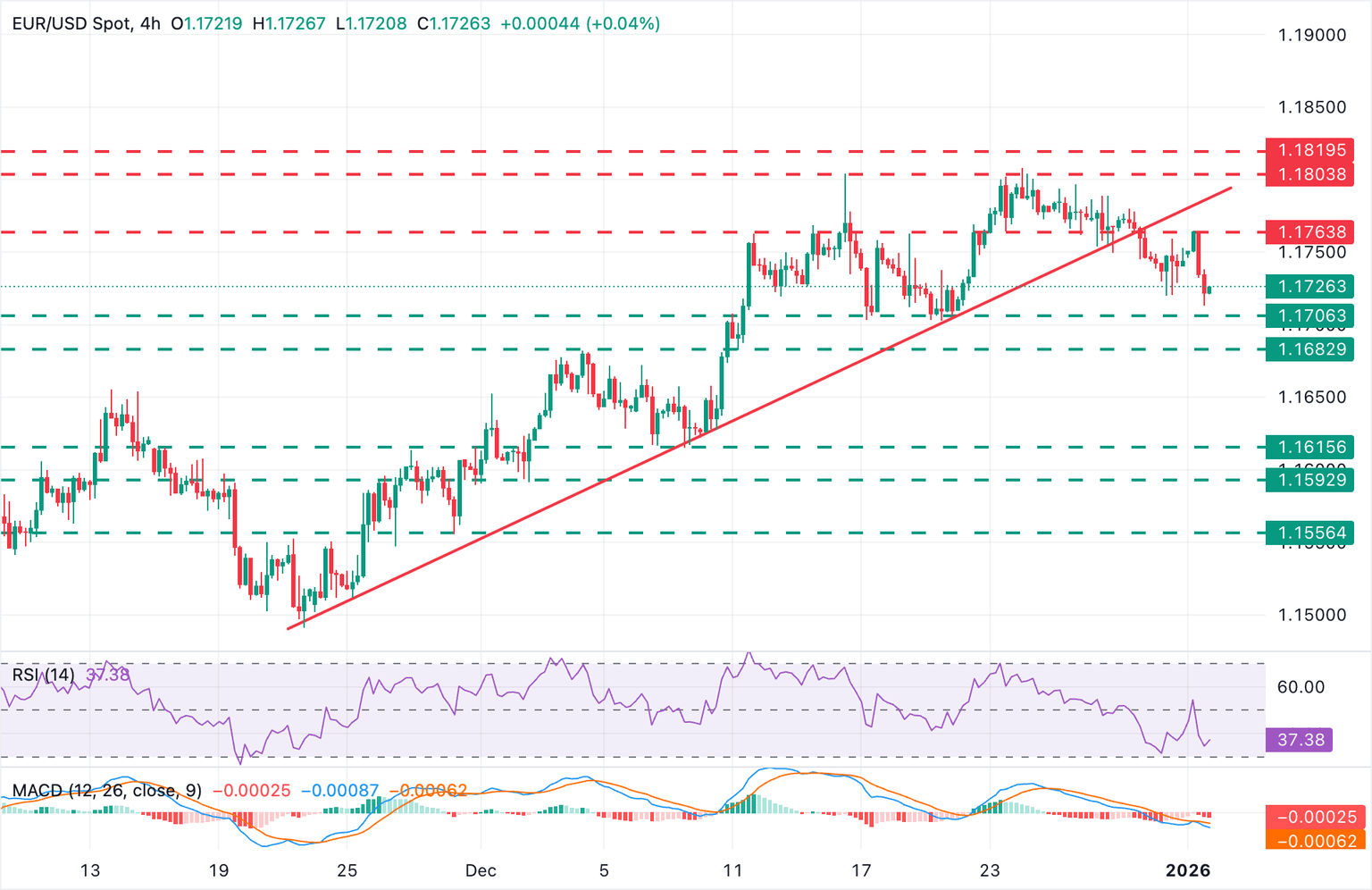

Technical analysis: EUR/USD is approaching support at the 1.1700 area

The EUR/USD immediate trend remains bearish, after breaking trendline support from the mid-November lows. The 4-hour Relative Strength Index (RSI) was rejected at the key 50 level, and the Moving Average Convergence and Divergence (MACD) turned lower after failing to cross the signal line, highlighting the growing bearish momentum.

However, the bears need to break the support at the December 17-19 lows, near 1.1700, to confirm the trend shift. In such a scenario, focus would shift towards the December 4 high and December 11 low, near 1.1680, and the December 8-9 low near 1.1615.

Upside attempts were set at 1.1764 earlier today. Furthermore, the reversal trend line at 1.1785 and the December 16 and 24 highs above 1.1800 are likely to form significant resistance.

Economic indicator

S&P Global Manufacturing PMI

the Standard & Poor’s Global The Manufacturing Purchasing Managers’ Index (PMI), released on a monthly basis, is a leading index that measures business activity in the manufacturing sector in the United States. Data are drawn from surveys of senior executives in private sector companies from the manufacturing sector. Survey answers reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as GDP, industrial production, employment and inflation. A reading above 50 indicates that the industrial economy is generally expanding, which is a bullish signal for the US dollar. Meanwhile, a reading below 50 indicates that activity in the manufacturing sector is generally declining, which is bearish for the US dollar.

Read more.

Latest version:

Tuesday 16 December 2025 at 14:45 (before)

repetition:

monthly

actual:

51.8

consensus:

52

former:

52.2

source:

Standard & Poor’s Global