The GBP/JPY pair hit a new multi-year high of 212.15 during the Asian trading session on Tuesday. The pair is trading solidly as the Japanese Yen (JPY) underperforms across the board, even as Bank of Japan (BoJ) Governor Kazuo Ueda indicates there will be more interest rate hikes in the near term.

Japanese yen price today

The table below shows how much the Japanese Yen (JPY) has changed against the major currencies listed today. The Japanese yen was the weakest against the New Zealand dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.06% | -0.05% | 0.05% | 0.02% | -0.17% | -0.18% | -0.03% | |

| euro | 0.06% | 0.02% | 0.09% | 0.08% | -0.10% | -0.12% | 0.03% | |

| GBP | 0.05% | -0.02% | 0.08% | 0.07% | -0.12% | -0.13% | 0.01% | |

| JPY | -0.05% | -0.09% | -0.08% | -0.03% | -0.21% | -0.23% | -0.08% | |

| Canadian | -0.02% | -0.08% | -0.07% | 0.03% | -0.18% | -0.20% | -0.05% | |

| Australian dollar | 0.17% | 0.10% | 0.12% | 0.21% | 0.18% | -0.01% | 0.13% | |

| New Zealand dollar | 0.18% | 0.12% | 0.13% | 0.23% | 0.20% | 0.01% | 0.14% | |

| Swiss franc | 0.03% | -0.03% | -0.01% | 0.08% | 0.05% | -0.13% | -0.14% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent the Japanese Yen (base)/US Dollar (quote).

“The Bank of Japan expects to continue raising interest rates if the economy and prices move in line with our expectations,” Governor Ueda said on Monday, adding that adjusting the degree of monetary support would help achieve “sustainable growth and stable inflation.”

This week, investors will focus on overall household spending data for November, which will be published on Friday. Data is expected to decline at a moderate pace of 1% versus a 3% contraction in October.

Meanwhile, the British pound is trading higher against its counterparts, excluding counter-currencies, as market sentiment turned positive after risks of conflict between the US and Venezuela receded. The British currency is expected to be largely driven by market expectations of the Bank of England’s (BoE) monetary policy outlook amid a light economic week in the UK.

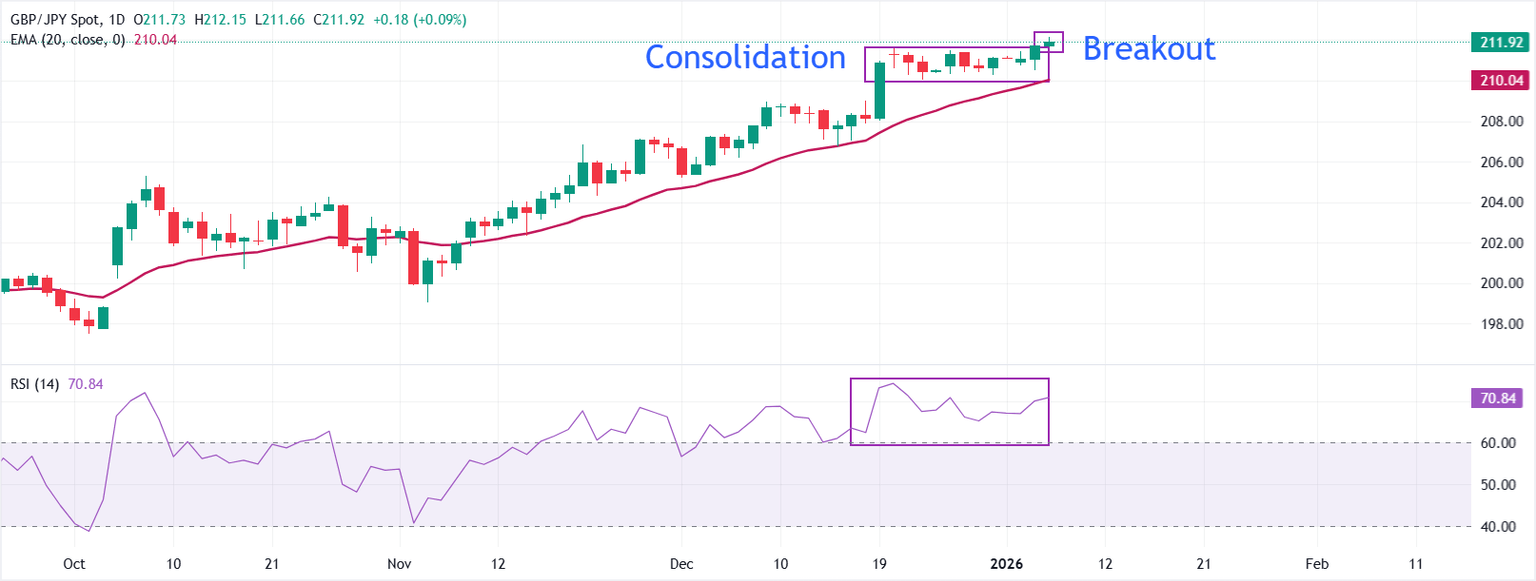

Technical analysis of GBP/JPY pair

On the daily chart, the GBP/JPY pair is trading at 211.92 as of writing. The 20-day EMA is rising and offering support at 210.04. The price stabilizes above this bullish scale, maintaining the bullish bias.

The 14-day RSI at 70.84 is positive but carries the risk of extended momentum.

As long as the pair remains above the bullish 20-day EMA, the trend is positive and may extend towards the 215.00 level. While a close below 210.04 may call for a corrective pullback towards the December 19 low at 208.00.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Bank of Japan Frequently Asked Questions

The Bank of Japan (BoJ) is Japan’s central bank, which sets the country’s monetary policy. Its mission is to issue banknotes and implement currency and monetary controls to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked on an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflation environment. The bank’s policy relies on quantitative and qualitative easing (QQE), or printing banknotes to purchase assets such as government bonds or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and eased its policy by first offering negative interest rates and then directly controlling the yields of its 10-year government bonds. In March 2024, the Bank of Japan raised interest rates, effectively reversing its ultra-loose monetary policy stance.

The massive incentives offered by the bank caused the value of the Japanese yen to decline against major currencies. This process was exacerbated in 2022 and 2023 by the growing policy divergence between the Bank of Japan and other major central banks, which chose to increase interest rates sharply to combat decades-long high levels of inflation. The Bank of Japan’s policy led to a widening of the spread with other currencies, which led to a decline in the value of the Japanese yen. This trend was partially reversed in 2024, when the Bank of Japan decided to abandon its overly accommodating policy stance.

The weakness of the Japanese yen and rising global energy prices led to an increase in Japanese inflation, which exceeded the Bank of Japan’s target of 2%. The prospect of higher salaries in the country – a key element fueling inflation – also contributed to the move.