The Indian Rupee (INR) is trading almost flat against its peers at the beginning of the week. The Indian rupee is stabilizing while rising oil prices and continued inflow of foreign funds from the Indian stock market keep it broadly under pressure.

Currencies from economies that rely heavily on oil imports to meet their energy needs are facing intense selling pressure in an environment of rising crude oil prices.

Global oil prices have risen nearly 6% since Thursday amid fears of supply disruptions, following civil unrest in Iran, which left nearly 500 civilians dead. “There have also been calls for oil industry workers to stop working amid the protests,” putting “at least 1.9 million barrels per day of oil exports at risk of disruption,” ANZ analysts said in a note cited by Reuters.

Meanwhile, continued selling by foreign institutional investors in the Indian stock market is keeping the Indian rupee under pressure. So far in January, FIIs have offloaded their quota worth Rs. Rs 11,786.82 crore. Foreign investors have aggressively reduced their stakes in the Indian stock market amid trade frictions between the US and India.

During the day, the US Ambassador to India, Sergio Gore, said that the two countries would talk about trade issues on Tuesday, Reuters reported. Gore also said that India will be invited to join PAX Seleka in February. Gore’s announcement of trade talks between the US and India on Tuesday triggered a strong bounce from the bulls in the Indian stock market. The Nifty50 quickly recovered its early losses and turned positive in the afternoon trading hours in India.

Domestically, India’s retail inflation data for December came in below expectations. The Retail CPI report showed that price pressures grew at an annual pace of 1.33%, below estimates of 1.5%, but faster than 0.71% in November.

Daily Summary Market Movers: The Indian Rupee is trading calmly against the US Dollar ahead of the Indo-US inflation data

- The Indian Rupee is trading flat against the US Dollar, with the USD/INR pair trading flat near 90.45. The pair declines marginally as the US dollar corrects sharply, in the wake of criminal charges against Federal Reserve Chairman Jerome Powell.

- At the time of writing, the US Dollar Index (DXY), which tracks the value of the dollar against six major currencies, is trading down 0.12% near 99.10. The DXY is correcting after revisiting the monthly high at 99.25.

- The Federal Reserve was filled with subpoenas on Friday from the US Department of Justice threatening criminal charges against Jerome Powell over his comments in Senate testimony last June, which related to “the renovation of historic buildings over a period of years at an estimated cost of $2.5 billion.”

- In response, Fed Chairman Powell stated that he “carry out my duties without political fear or favor and will continue to do so,” and that “the new threat is not about his testimony or the renewal project but about a pretext.” Powell explained that the criminal charges against him are “the result of the Fed setting interest rates based on our assessment of the public interest rather than the president’s preferences.”

- In the past, US President Trump criticized Fed Chairman Powell several times for not cutting interest rates aggressively.

- Going forward, investors will focus on the US CPI data for December, which will be released on Tuesday. The impact of US inflation data will be significant on the Fed’s monetary policy outlook. Economists expect core inflation in the US to rise faster to 2.7% year-on-year from 2.6% in November, with headline numbers growing steadily at 2.7%.

- On Friday, a lower-than-expected US unemployment rate and a strong wage growth measure boosted the appeal of the US dollar. The Non-Farm Payrolls (NFP) report showed that the unemployment rate fell to 4.4% from 4.6% in November, while it was expected to fall to 4.5%. Average hourly earnings, a key measure of wage growth, grew at an annual pace of 3.8%, faster than expectations and the previous reading of 3.6%.

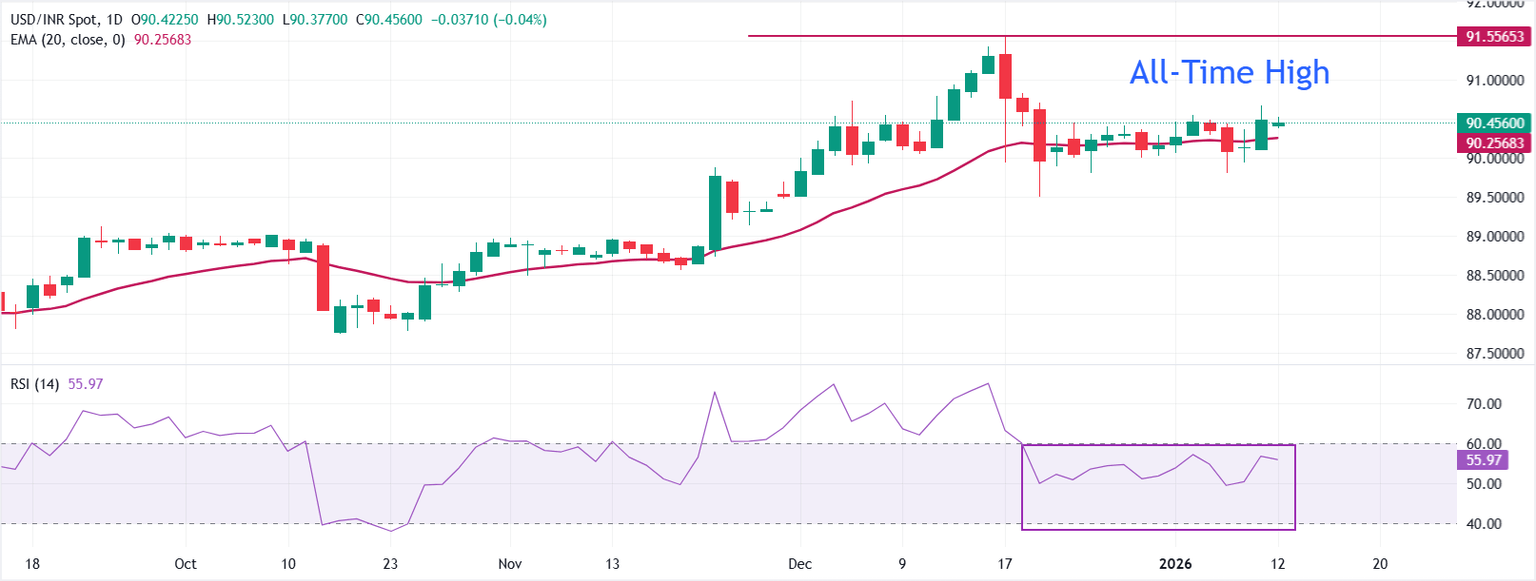

Technical Analysis: The USD/INR pair is oscillating around the 90.50 level

On the daily chart, USD/INR is trading slightly lower at 90.4665. The price holds above the high 20 Exponential Moving Average (EMA) at 90.2578, keeping the short-term bias skewed to the upside as the averages rise.

The 14-day Relative Strength Index (RSI) at 56 (neutral) reflects steady momentum without overbought pressure, allowing room to hold above the average.

Pullbacks are expected to find initial support at the 20 EMA at 90.2578. A decisive break below would lead to a further decline towards the December 19 low at 89.50. As long as the RSI remains above 50, declines should remain contained, and the price may attempt to revisit its all-time high at 91.55.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Frequently asked questions about Indian economy

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, making it one of the fastest growing economies in the world. India’s high growth has attracted a lot of foreign investment. This includes foreign direct investment (FDI) in physical projects and foreign indirect investment (FII) by foreign funds in Indian financial markets. The higher the investment level, the greater the demand for the rupee (INR). Fluctuations in dollar demand from Indian importers also affect the Indian rupee.

India has to import a significant amount of its oil and gasoline needs, so the oil price can have a direct impact on the rupee. Oil is mostly traded in US dollars (USD) in international markets, so if the price of oil rises, the overall demand for USD increases and Indian importers have to sell more rupees to meet this demand, which leads to a depreciation of the rupee.

Inflation has a complex impact on the rupee. It ultimately indicates an increase in money supply which reduces the overall value of the rupee. However, if the interest rate rises above the RBI’s target level of 4%, the bank will raise interest rates to bring it down by reducing credit. Rising interest rates, especially real rates (the difference between interest rates and inflation) boost the rupee. It makes India a more profitable place for international investors to put their money. Lower inflation could be supportive for the rupee. Meanwhile, low interest rates could have a negative impact on the rupee.

India has run a trade deficit for most of its modern history, suggesting that its imports exceed its exports. Since the majority of international trade is conducted in US dollars, there are times – due to seasonal demand or abundant demand – when a high volume of imports creates a large demand for US dollars. During these periods the rupee can weaken as it is sold heavily to meet the demand for dollars. When markets witness increased volatility, demand for the US dollar can also rise with a corresponding negative impact on the rupee.