The USD/CAD pair fell after failing to extend its nine-day winning streak on Monday. The Canadian dollar pair corrects to approximately 1.3890 during the day as the US dollar (USD) declines, following the criminal charges against Federal Reserve Chairman Jerome Powell.

At press time, the US Dollar Index (DXY), which tracks the value of the US currency against six major currencies, was down 0.22% near 98.90. The DXY is correcting after recording a new monthly high near 99.26 on Friday.

On Friday, the US Department of Justice sent a subpoena to the Federal Reserve against Chairman Jerome Powell over his comments in his testimony before the Senate last June, which related to the “renovation of historic buildings over the years at an estimated cost of $2.5 billion.”

The Fed’s Powell responded that these accusations were not related to “his testimony or the renewal project, but rather a pretext.”

Meanwhile, the Canadian Dollar (CAD) is broadly under pressure as the unemployment rate rose to 6.8% from an estimate of 6.6% and the previous reading of 6.5%. Rising unemployment may raise expectations that the Bank of Canada (BoC) will resume its monetary easing campaign soon.

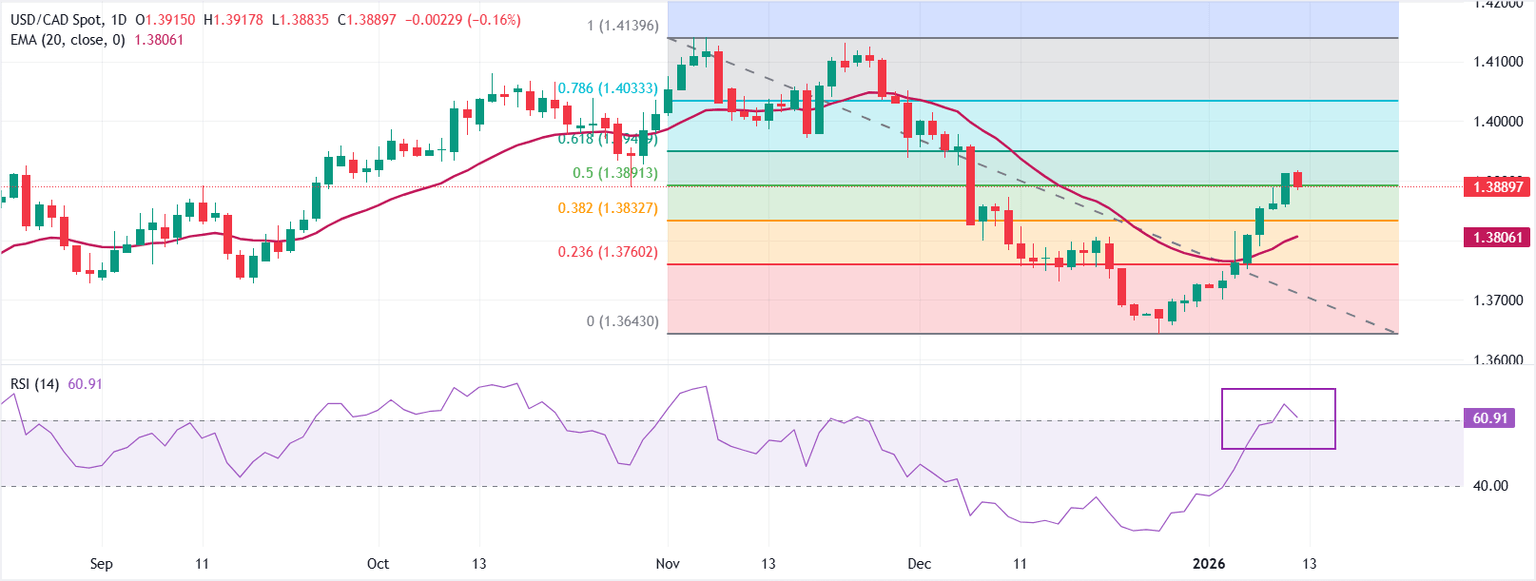

Technical analysis of the USD/CAD pair

USD/CAD is trading at around 1.3890 on Monday. The 20-day Exponential Moving Average (EMA) has turned to the 1.3806 level, with the price holding above it and strengthening the near-term recovery bias.

The 14-day Relative Strength Index (RSI) at 61 is showing strong positive momentum after bouncing from the oversold zone.

Measured from the high of 1.4140 to the low of 1.3643, the 50% Fibonacci retracement levels at 1.3891 act as immediate resistance. Above that level, a 61.8% retracement at 1.3950 would cap the next push.

Failure to clear nearby resistance will keep the bounce contained, with pullbacks set to find initial support at the bullish 20-day EMA near 1.3806.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Economic indicator

Unemployment rate

Unemployment rate issued by Statistics Canadais the number of unemployed workers divided by the total civilian labor force as a percentage. It is a leading indicator of the Canadian economy. If the rate rises, it indicates a lack of expansion within the Canadian labor market and a weakness in the Canadian economy. Generally, a decrease in the number is viewed as bullish for the Canadian Dollar (CAD), while an increase is viewed as bearish.

Read more.

Latest version:

Friday 09 January 2026 at 13:30

repetition:

monthly

actual:

6.8%

consensus:

6.6%

former:

6.5%

source:

Statistics Canada