US stocks opened 2026 on a cautious note, with the S&P 500 and Nasdaq essentially flat, as strength in semiconductors offset weakness elsewhere in technology. The Dow Jones found some support on Friday after an early decline during the overnight session, holding steady near where the first trading day of 2026 began.

Looking ahead, Wall Street strategists remain broadly optimistic about US stocks through 2026. The latest CNBC strategist poll puts the S&P 500’s average target at 7,629, implying a double-digit rise for the year. Some strategists expect market leadership to expand beyond big technology, with a rotation into regional banks and other non-technology sectors, while value-rich technology names may lag behind.

Semiconductor markets stabilize after the technology boom in 2025

Chipmakers like Nvidia (NVDA) and Micron (MU) advanced, building momentum from a strong 2025 led by AI spending, while software names including Salesforce (CRM) and CrowdStrike (CRWD) fell. Tesla (TSLA) also weighed on sentiment after it reported fourth-quarter deliveries well below expectations. Despite a weak start to the year, 2025 closed with strong gains across major benchmarks, with the S&P 500 up more than 16%, the Nasdaq up more than 20%, and the Dow Jones adding nearly 13%, all reaching record levels during the year.

Tariff pause sparks comfort rise in furniture inventories

Beyond technology, furniture and home goods stocks rose after US President Donald Trump postponed planned tariff hikes on upholstered furniture, kitchen cabinets and dressing tables by one year. Wayfair (W), RH, and Williams-Sonoma (WSM) shares rose as investors reevaluated cost pressures associated with trade policy. The tariff pause follows a sharp divergence within the sector in 2025, when value-oriented retailers soared while high-end brands suffered amid concerns about sourcing and volatile demand.

On the economic front, US manufacturing activity slowed modestly in December as new orders slowed, according to results of the global Standard & Poor’s Purchasing Managers’ Index (PMI) survey. December’s manufacturing PMI remained in expansion territory, while job creation accelerated to its fastest pace since August and price pressures eased, suggesting a mixed but stable backdrop to growth.

Leadership shifts at the Fed and corporates loom large over 2026

The Federal Reserve’s leadership stands out as a major uncertainty for markets this year. Federal Reserve Chairman Jerome Powell has refused to say whether he will remain on the Fed’s board when his term ends in May, sparking debate about the future balance of power within the central bank. If Powell steps down entirely, President Trump would gain immediate influence over the FOMC majority, potentially reshaping the direction of monetary policy. Most Fed watchers expect Powell to leave, citing institutional precedent and concerns about the politicization of the central bank, though the decision remains unresolved and being closely watched.

In corporate leadership news, Warren Buffett has officially handed over the CEO role at Berkshire Hathaway (BRK) to Greg Appel, ending a six-decade tenure that transformed the company into a trillion-dollar conglomerate. Buffett expressed strong confidence in Abel’s leadership and capital allocation skills, even as Berkshire shares have lagged since the succession announcement amid investor questions about the post-Buffett era. Buffett stressed the company’s long-term durability, highlighting Berkshire’s deep cash reserves and diverse business mix as it enters a new chapter.

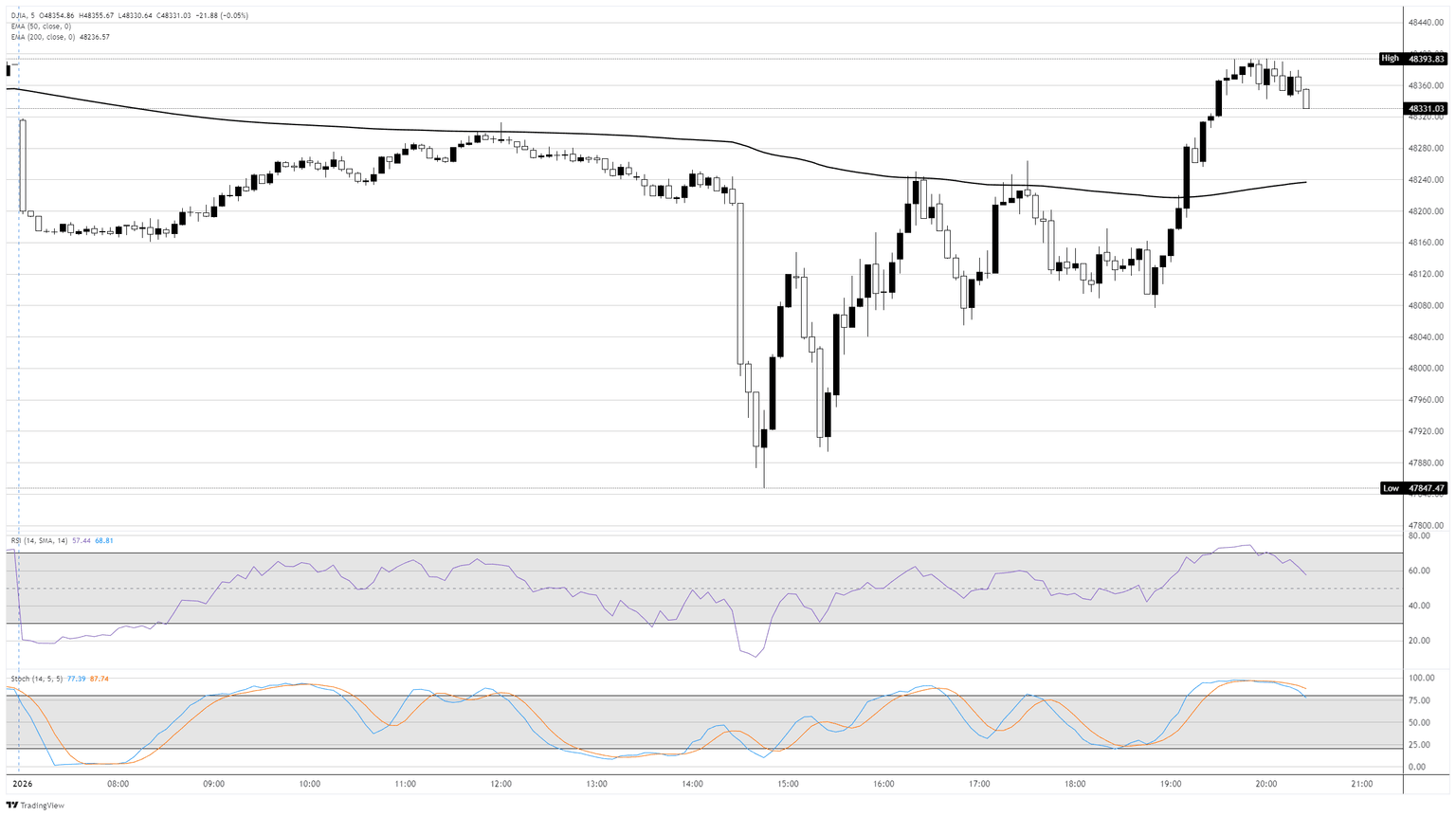

Dow Jones 5-Minute Chart

Dow Jones FAQs

The Dow Jones Industrial Average is one of the oldest stock market indexes in the world, consisting of the 30 most actively traded stocks in the United States. The index is price-weighted and not market capitalization-weighted. It is calculated by summing the component stock prices and dividing them by a factor that currently amounts to 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years, it was criticized for not being broadly representative enough because it tracks only 30 conglomerates, unlike broader indices such as the S&P 500.

There are many different factors that drive the Dow Jones Industrial Average (DJIA). The overall performance of the constituent companies disclosed in the company’s quarterly earnings reports is the headline performance. US and global macroeconomic data also contribute to its impact on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also affects the Dow Jones Industrial Average because it affects the cost of credit, on which many companies rely heavily. Therefore, inflation can be a key driver along with other metrics that influence the Fed’s decisions.

Dow Theory is a method of determining the fundamental trend of the stock market developed by Charles Dow. The basic step is to compare the trend of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Size is a confirmatory criterion. The theory uses elements of peak and trough analysis. Dow Theory postulates three phases of a trend: accumulation, when smart money starts buying or selling; Public participation, when the wider public joins in; And distribution, when the smart money comes out.

There are a number of ways to trade the DJIA. The first is the use of ETFs that allow investors to trade the Dow Jones Industrial Average as a single security, rather than having to buy shares in all 30 component companies. A leading example of this is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures allow traders to speculate on the future value of an index and options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to purchase a share of a diversified portfolio of DJIA stocks and thus provide exposure to the overall index.