US stocks have remained relatively stable since our last report, but a number of issues tend to rattle markets. In today’s report we’ll take a look at the Fed’s interest rate decision, the Warner Bros acquisition and its impact on Netflix, NVIDIA chip exports and the ban on social media accounts in Australia. We conclude the report with a technical analysis of the daily chart of the S&P 500 index.

Interest rate decision of the Federal Reserve

We’re highlighting the Fed’s interest rate decision today as the key issue of the week for US stocks. The bank is widely expected to cut interest rates and the market appears to be maintaining some dovish expectations for the next day, with three more rate cuts expected in 2026. Therefore, even if the bank cuts the expected interest rates, it may take more for US stocks to gain some strength. If the bank cuts interest rates as expected, the market’s focus will shift towards the Fed’s future guidance. The bank’s future guidance will be described in the statement accompanying the new dot chart and Fed Chair Powell’s press conference. If the new dot plot does show that Fed policymakers expect interest rates to fall below 75 basis points in 2026, the market expects it to be seen as a hawkish signal that could impact US stock markets. Fed Chair Powell’s press conference should also be used with caution as he is known for his ability to reflect market sentiment. Possible hawkish comments by the Fed Chairman, which go against the markets’ dovish outlook, may also force the market to adjust its expectations and thus could impact US stocks. Overall, our base scenario is a hawkish cut, but if the bank allows for a scenario of further easing in monetary policy next year, and perhaps broader easing than the market expects, we could see US stock markets rally.

Hollywood drama produced by Netflix

The market was stunned on Friday when Netflix’s acquisition of Warner Bros. was announced. Discovery for $72 billion. It should be noted that a bidding war was ongoing and involved Paramount Skydance and Comcast. Although approval of the deal was still pending, due to antitrust laws, within three days, Paramount Skydance made a competing, all-cash bid for Warner Bros. Television. Discovery in its entirety, directly to investors. The move is widely viewed as a hostile takeover, and is said to have been financed by a group of banks, billionaires and sovereign wealth funds, while also being backed by Jared Kushner, US President Trump’s son-in-law, also providing a political dimension to the issue. The US Supreme Court also reportedly appears ready to enforce antitrust regulations, members of Congress are sharply questioning the takeover, and Netflix is now facing a class-action lawsuit. As the deal appears to be heading south, Netflix’s stock price has also taken the same direction, and if the news continues to be negative for the streaming company, we could see its stock price lose more ground.

NVIDIA chipset exports

NVIDIA’s stock price got some support on Monday as US President Trump gave the company his blessing to export H200 chips to China. The news provided some modest support to NVIDIA’s stock price, as such a license could allow NVIDIA to significantly expand its sales. It should be noted that this news at the same time created great concerns among members of the US Congress from the Republican Party regarding national security threats. However, it’s worth noting that NVIDIA has built in location verification technology that would show which country the chip works in, which may somewhat alleviate political concerns in Washington. However, the problem seems to lie in China. The Chinese have responded positively, but regulators in Beijing are discussing ways to limit access to NVIDIA’s H200 chips, in an effort to boost production of its own chips. For now, we see the issue on the positive side for NVIDIA, however strong restrictions from China could dampen if not reverse support for its stock price.

Australia bans social media

Australia today began enforcing a social media ban for children under 16. Australia has ordered the owners of major platforms such as TikTok, YouTube, Instagram and Facebook to ban children or face the possibility of fines of up to A$49.5 million, in light of new legislation. Implementation of the ban has been closely watched by regulators around the world and is considered critical, and if it proves successful, other countries may follow suit. The share prices of giant technology companies that own such platforms, such as Google and Meta, could suffer losses, because a potential successful ban could limit their users and thus their income.

Technical analysis

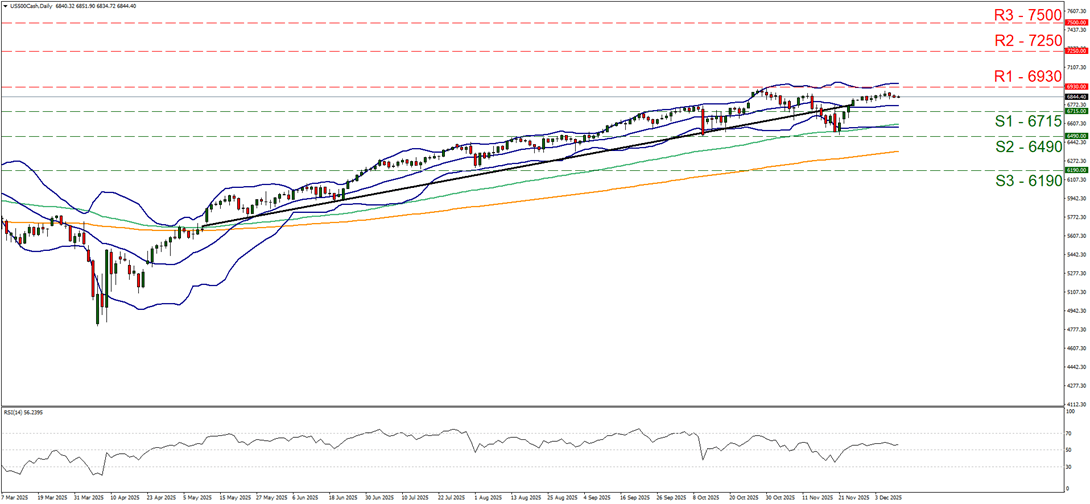

US500 daily chart

- Supports: 6715(S1), 6490(S2), 6190(S3).

- resistance: 6930(R1), 7250(R2), 7500(R3).

On the technical level, we note that since our last report the S&P 500 seems to have stabilized, maintaining a sideways movement below the 6930 resistance barrier (R1). We tend to maintain a bias for continued sideways movement in the current phase, perhaps between the 6930 resistance line (R1) and the 6715 support level (S1). The RSI remains close to the 50 reading, just above it, indicating relative indecisiveness on behalf of traders about the future direction of the index’s price movement. If the bulls take control, we may see the S&P 500 break the 6930 resistance (R1) which represents a record high for the index and identify the 7250 resistance (R2) as a next potential target for the bulls. If the bears take control, we may see the price action of the index break the 6715 (S1) support barrier and start targeting the 6400 (S2) support level.