Germany’s annual inflation, measured by the change in the consumer price index, fell to 1.8% year-on-year in December from 2.3% in November, the German statistics office reported on Tuesday. On a monthly basis, the CPI remained unchanged, compared to market expectations for an increase of 0.2%.

In this period, the Harmonized Index of Consumer Prices (HICP), the European Central Bank’s (ECB) preferred measure of inflation, rose by 2% year-on-year. This reading followed the 2.6% increase recorded in November and was lower than analysts’ estimates of 2.2%.

Market reaction to German inflation data

EUR/USD remains under modest downside pressure following weak inflation readings from Germany, and was last seen losing 0.2% on the day at 1.1700.

Euro price today

The table below shows the percentage change of the Euro (EUR) against the major currencies listed today. The euro was weakest against the Australian dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | 0.22% | 0.27% | 0.16% | 0.13% | -0.02% | 0.11% | 0.31% | |

| euro | -0.22% | 0.04% | -0.09% | -0.08% | -0.23% | -0.11% | 0.09% | |

| GBP | -0.27% | -0.04% | -0.13% | -0.13% | -0.28% | -0.16% | 0.05% | |

| JPY | -0.16% | 0.09% | 0.13% | -0.00% | -0.16% | -0.03% | 0.17% | |

| Canadian | -0.13% | 0.08% | 0.13% | 0.00% | -0.16% | -0.03% | 0.17% | |

| Australian dollar | 0.02% | 0.23% | 0.28% | 0.16% | 0.16% | 0.13% | 0.33% | |

| New Zealand dollar | -0.11% | 0.11% | 0.16% | 0.03% | 0.03% | -0.13% | 0.19% | |

| Swiss franc | -0.31% | -0.09% | -0.05% | -0.17% | -0.17% | -0.33% | -0.19% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select EUR from the left column and move along the horizontal line to USD, the percentage change displayed in the box will represent EUR (base)/USD (quote).

(This section below is published as an introduction to German inflation data.)

Flash overview of German HICP data

Preliminary data for the German consolidated consumer price index (HICP) for December is scheduled to be released today at 13:00 GMT.

The German Federal Statistics Office is expected to show that the HICP index rose at an annual rate of 2.2%, slower than 2.6% in November. On a monthly basis, price pressures are expected to grow sharply by 0.4% after contracting by 0.5% last month.

Earlier in the day, inflation data from four German states – Brandenburg, Hesse, Saxony and North Rhine-Westphalia – showed that the Consumer Price Index (YoY) grew at a moderate pace, while on a monthly basis, the growth in inflationary pressures was faster.

CPI data for the other German states, Bavaria and Baden-Württemberg, will be published on Wednesday. On the same day, Eurostat will publish preliminary Eurozone CPI data for December.

The impact of the preliminary German CPI data for December will be significant on market expectations of the ECB’s monetary policy outlook, given that the German economy is the largest country in the eurozone in terms of population and trade.

How could flash German HICP data impact EUR/USD?

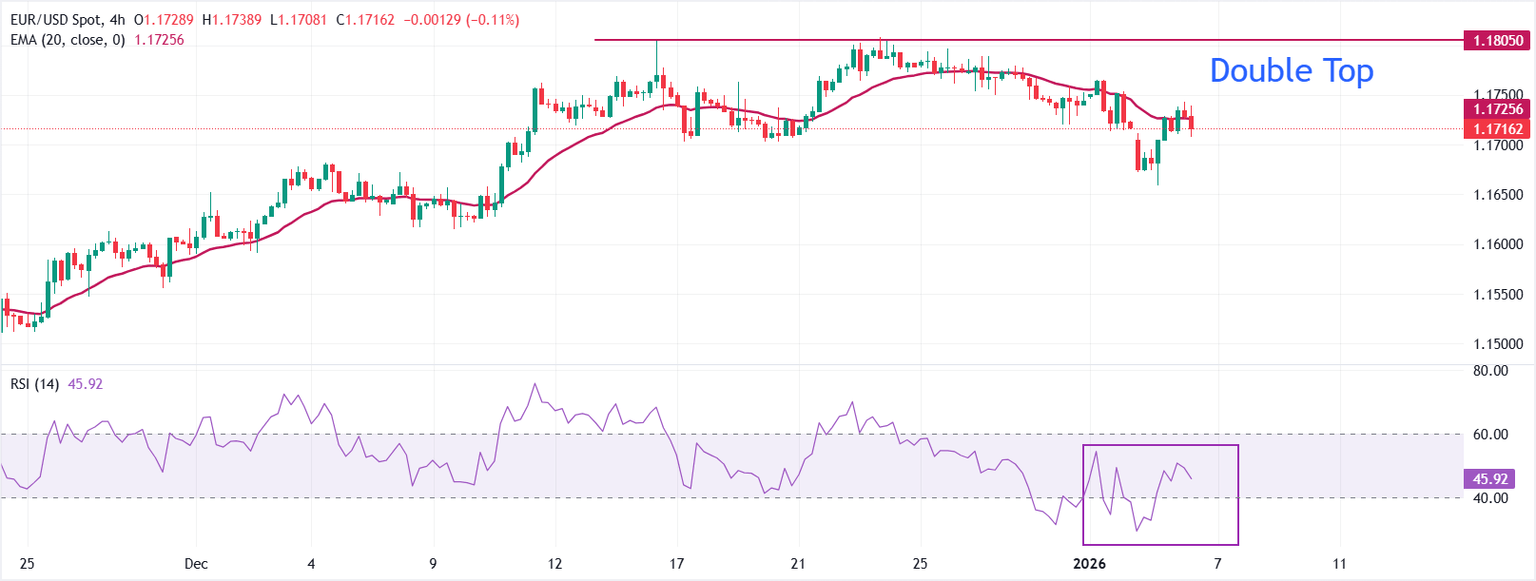

EUR/USD is trading 0.11% lower to approach 1.1717 ahead of the German CPI data. On the four-hour time frame, the major currency pair is holding below the 20-period Exponential Moving Average (EMA), which is sloping lower at 1.1726 and capping intraday gains. The 20 EMA has been steadily declining, keeping the near-term bias at bay.

The pair has been under pressure in the past few weeks amid the formation of a double top, which indicates that an intermediate top has been established.

The 14-period Relative Strength Index (RSI) at 46 (neutral) is weak, confirming the fading of bullish momentum.

Below the bearish average, sellers remain in control and could push the price down near the December 2025 low at 1.1600. On the upside, a clear close above the December 16 high at 1.1804 could open the door for further gains towards the September 17, 2025 high at 1.1919.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

(This story was corrected at 11:04 GMT to say in the fifth paragraph that the impact of preliminary German CPI data for December, not September, will be significant.)

Frequently asked questions about inflation

Inflation measures the rise in the prices of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a monthly (MoM) and yearly (YoY) basis. Core inflation excludes more volatile items such as food and fuel, which can fluctuate due to geopolitical and seasonal factors. Core inflation is the number that economists focus on and is the level targeted by central banks, which are tasked with keeping inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a monthly (MoM) and yearly (YoY) basis. The core CPI is the number targeted by central banks because it excludes volatile food and fuel inputs. When the core CPI rises above 2%, it typically causes interest rates to rise and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually leads to a stronger currency. The opposite is true when inflation falls.

Although it may seem counterintuitive, high inflation in a country causes the value of its currency to rise and vice versa for lower inflation. This is because the central bank will typically raise interest rates to combat rising inflation, which attracts more global capital flows from investors looking for a profitable place to park their money.

Previously, gold was the asset investors turned to during times of high inflation because it maintained its value, and while investors will often continue to buy gold for its safe holdings in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will raise interest rates to combat it. High interest rates are negative for gold because they increase the opportunity cost of holding gold versus interest-bearing assets or putting money in a cash deposit account. On the flip side, lower inflation tends to be positive for gold because it lowers interest rates, making the shiny metal a more viable investment alternative.