Gold (XAU/USD) is trading slightly stronger on Tuesday after posting gains of more than 2.5% the previous day, driven by a surge in safe-haven demand in the wake of the US attacks on Venezuela. At the time of writing, the XAU/USD pair is trading at around $4,470, up approximately 0.50% on the day.

While safe-haven demand remains high, new buying has eased following Monday’s sharp advance as investors continue to monitor developments in the US-Venezuela relationship. Over the weekend, US armed forces arrested Venezuelan President Nicolas Maduro and brought him to New York, where Maduro faces charges of narco-terrorism and drug trafficking.

While safe-haven demand remains high, new buying has eased after Monday’s sharp advance, with a modest rebound in the US dollar (USD) and US Treasury yields capping further upside. At the same time, the relatively stable risk sentiment in global equity markets is also reducing additional safe haven flows.

However, ongoing geopolitical tensions and continued expectations of the Fed cutting interest rates twice this year continue to support gold’s broader bullish bias, keeping prices steady below record highs.

Traders are also eyeing upcoming US jobs data later this week, which could shape the Fed’s near-term outlook and provide the next trend signal for bullion.

Market Drivers: Markets are digesting the fallout from Venezuela and weak US factory data

- The latest global Standard & Poor’s Purchasing Managers’ Index (PMI) surveys showed US business activity losing momentum in December, with the services PMI falling to 52.5 from 54.1 and the composite PMI falling to 52.7 from 54.2.

- Federal Reserve officials struck a cautious but somewhat pessimistic tone on Tuesday. Both sides of the Fed’s dual mandate are “watching the decline,” Richmond Fed President Thomas Barkin said, adding that the interest rate is within the neutral range and that upcoming decisions will need to be “fine-tuned” given risks to inflation and employment. Separately, Fed Governor Stephen Meiran said incoming data should continue to suggest that interest rate cuts are appropriate, warning that keeping policy too tight could “nip growth in the bud,” while adding that he remains optimistic about the economic outlook.

- Venezuelan President Nicolas Maduro appeared alongside his wife before a federal judge in New York on Monday and pleaded not guilty, saying: “I am innocent. I am not guilty. I am a respectable man, the president of my country.”

- Following the attacks, US President Donald Trump told reporters on Sunday that the United States would “temporarily run” Venezuela. Meanwhile, newly inaugurated President Delcy Rodriguez said late Monday that Venezuela seeks cooperation, adding: “We call on the United States government to cooperate with us on a cooperation agenda geared toward common development within the framework of international law.”

- The US dollar recovered on Tuesday after coming under pressure on Monday following the release of weak ISM manufacturing PMI data. The US Dollar Index (DXY), which tracks the value of the greenback against a basket of six major currencies, is trading around 98.58 after falling to 98.16 earlier in the Asian session.

- The ISM Manufacturing PMI remained in contraction territory in December at 47.9, missing expectations of 48.3 and falling from 48.2 in November. The prices paid index settled at 58.5, below expectations of 59. The employment index rose to 44.9 from 44, while the new orders index contracted for the fourth straight month in December after one month of growth, rising to 47.7 from 47.4.

- Minneapolis Fed President Neel Kashkari said Monday that his “guess” is that monetary policy is now close to neutral, while adding that he expects the U.S. economy to remain resilient. Kashkari also noted that there is a risk that the unemployment rate could rise and cited persistent inflation as a key concern.

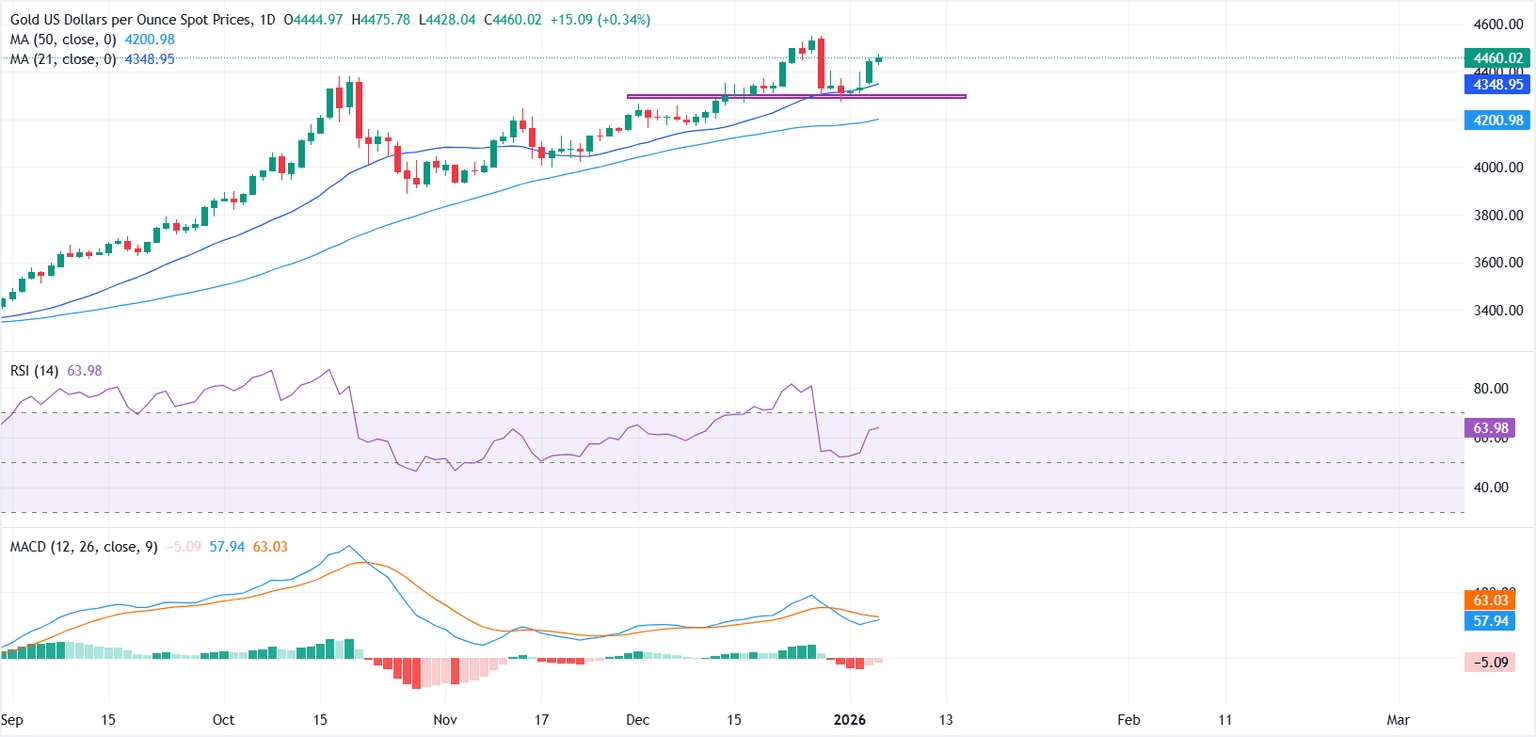

Technical Analysis: Rising moving averages keep bullish bias intact

From a technical perspective, the daily chart reflects a broadly constructive setup. The 21-day SMA remains above the 50-day SMA, with both indicators slanted higher and prices holding comfortably above them.

On the downside, the 21-day simple moving average near $4,348.80 provides the first layer of dynamic support, ahead of the $4,300 psychological level. A deeper pullback could see buyers defending the 50-day simple moving average around $4,200.92, which continues to support the broader uptrend.

On the upside, the $4450-$4470 area caps the immediate advance. A sustained break above this barrier would expose an all-time high near $4,549, with room for further upside extension if bullish momentum accelerates.

Momentum indicators stabilize. The Moving Average Convergence Divergence (MACD) indicator remains below its signal line and below the zero mark, but the downside histogram is contracting, indicating fading downward pressure. Meanwhile, the Relative Strength Index (RSI) stands near 64, reflecting positive momentum without overbought conditions emerging yet.

Frequently asked questions about gold

Gold has played a major role in human history as it has been widely used as a store of value and a medium of exchange. Currently, apart from its luster and use in jewellery, the precious metal is widely viewed as a safe haven asset, meaning it is a good investment during turbulent times. Gold is also widely viewed as a hedge against inflation and currency depreciation because it is not dependent on any specific issuer or government.

Central banks are the largest holders of gold. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and purchase gold to improve the perceived strength of the economy and the currency. High gold reserves can be a source of confidence for a country’s solvency. Central banks added 1,136 tons of gold worth about $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest annual purchase since records began. Central banks in emerging economies such as China, India and Turkey are rapidly increasing their gold reserves.

Gold has an inverse relationship with the US dollar and US Treasuries, which are major reserve assets and safe havens. When the value of the dollar declines, gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rise in the stock market tends to weaken the price of gold, while a sell-off in riskier markets tends to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession could cause the price of gold to rise rapidly due to its safe-haven status. As a lower-yielding asset, gold tends to rise as interest rates fall, while a higher cost of money usually negatively impacts the yellow metal. However, most of the moves depend on how the US Dollar (USD) behaves as the asset is priced in Dollars (XAU/USD). A stronger dollar tends to keep the price of gold in check, while a weaker dollar is likely to push gold prices higher.