The Japanese Yen (JPY) reflects a modest intraday decline against the broadly weaker US Dollar (USD), and looks to build on an overnight rebound from an almost two-week low, which it touched the previous day. Speculation that Japanese authorities will intervene to prevent the local currency from weakening too quickly and expectations of further policy tightening by the Bank of Japan (BoJ) turn out to be major factors that continue to act as a catalyst for the Japanese yen.

Meanwhile, the Bank of Japan’s hawkish outlook marks a significant contrast to bets on further interest rate cuts by the US Federal Reserve, keeping the US dollar low and benefiting the low-yielding Japanese yen. However, uncertainty about the potential timing of the next interest rate hike from the Bank of Japan may limit the Japanese yen. Furthermore, financial concerns and a positive risk tone require caution before placing strong bullish bets around the Japanese yen.

The Japanese yen maintains its bullish bias against the US dollar amid interest rate hike bets from the Bank of Japan

- Investors appear uncertain about the pace of policy tightening by the Bank of Japan amid expectations that energy support, stable rice prices and lower oil costs would keep inflation low until 2026. This, coupled with fiscal concerns due to Prime Minister Sanae Takaishi’s wide-ranging spending plans to stimulate growth, failed to help the Japanese yen benefit from Monday’s rebound from a two-week low against the US dollar.

- Bank of Japan Governor Kazuo Ueda said Monday that the central bank will continue to raise interest rates if economic developments and prices move in line with his expectations. Ueda added that adjusting the degree of monetary support will help the economy achieve sustainable growth, and that wages and prices are likely to rise together moderately. This keeps the door open for further BOJ policy normalization.

- The tightening outlook has pushed the yield on interest rate-sensitive two-year Japanese government bonds to their highest level since 1996. The yield on Japan’s benchmark 10-year government bond reached its highest point since 1999 on Monday. Narrowing the interest rate differential between Japan and other major economies could help limit any significant decline in the Japanese yen amid speculation about possible government intervention.

- Meanwhile, the US dollar is looking to extend the previous day’s decline from its highest levels in almost four weeks amid growing bets on further policy easing by the Federal Reserve. In fact, traders are anticipating the possibility that the Fed will cut borrowing costs in March and possibly deliver another rate cut later this year. The bets were confirmed once again by mixed December 2025 US PMI data released on Monday.

- In fact, the US S&P Global Manufacturing PMI remained steady at 51.8 and indicated continued expansion. In contrast, the Institute for Supply Management (ISM) manufacturing PMI showed signs of continued contraction and fell to 47.9 from 48.2 in November. This keeps US dollar bulls on the defensive during the Asian session on Tuesday and also contributes to capping the upside for USD/JPY.

- Traders are eagerly awaiting the release of the US Non-Farm Payrolls report on Friday, which will be considered, along with other important US macro data this week, for signals on the path of the Fed’s rate cut. This, in turn, will play a major role in determining the course of the US dollar and providing new directional momentum for the USD/JPY pair. However, the broader fundamental backdrop appears to be favoring JPY bulls.

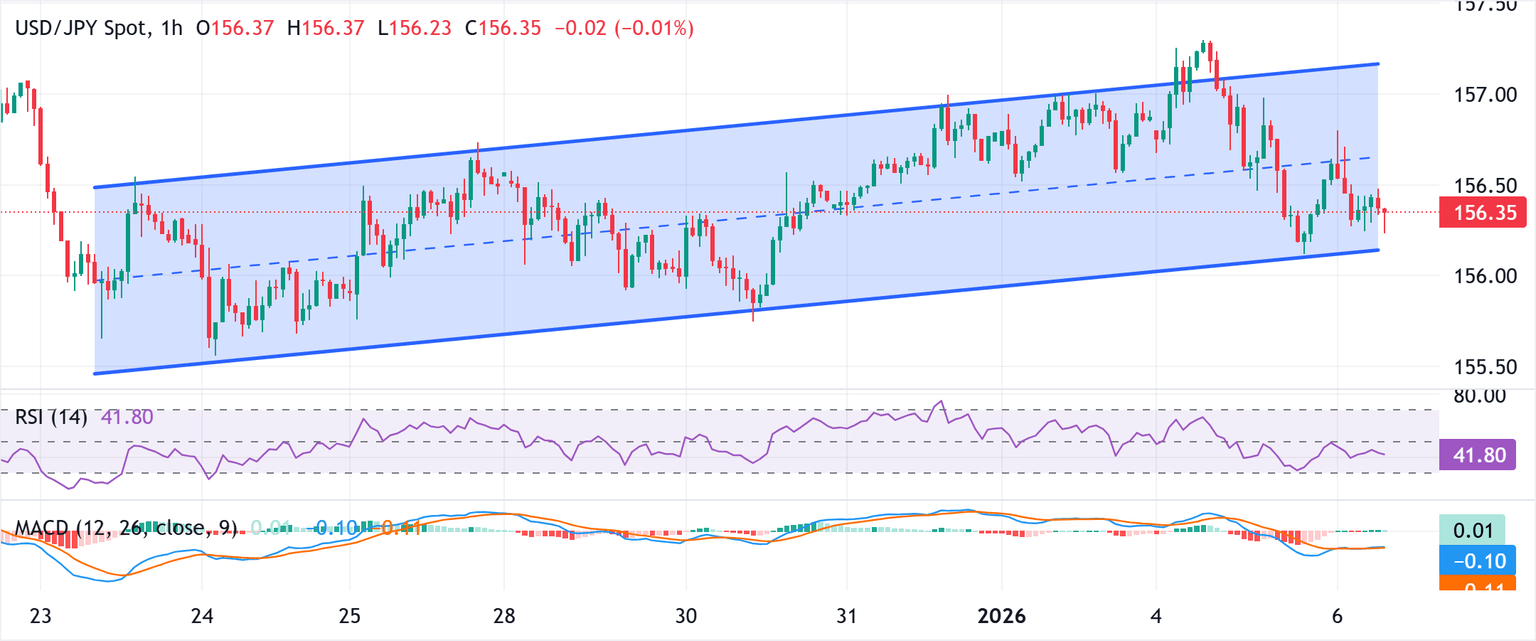

USD/JPY bears may wait for a breakout below ascending channel support near 146.00

The rising channel from 155.46 supports the upside, with the lower boundary near 156.13 to mitigate pullbacks. The short-term moving averages have stabilized, reflecting consolidation within the bullish structure. The Moving Average Convergence Divergence (MACD) indicator is just above the zero line, indicating the bearish pressure is fading. The RSI is recording 43 (neutral), keeping the uptrend contained without indicating oversold conditions. A break above the channel ceiling at 157.16 would open the next leg higher, while failure to attract follow-on offers could pull USD/JPY back towards the lower limit of the channel.

(Technical analysis of this story was written with the help of an artificial intelligence tool)

US dollar price this week

The table below shows the percentage change in the US Dollar (USD) against the major currencies listed this week. The US dollar was the strongest against the Canadian dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.07% | -0.62% | -0.31% | 0.11% | -0.81% | -0.79% | -0.14% | |

| euro | 0.07% | -0.56% | -0.18% | 0.18% | -0.75% | -0.72% | -0.07% | |

| GBP | 0.62% | 0.56% | 0.28% | 0.75% | -0.19% | -0.16% | 0.49% | |

| JPY | 0.31% | 0.18% | -0.28% | 0.41% | -0.53% | -0.50% | 0.20% | |

| Canadian | -0.11% | -0.18% | -0.75% | -0.41% | -0.77% | -0.91% | -0.25% | |

| Australian dollar | 0.81% | 0.75% | 0.19% | 0.53% | 0.77% | 0.02% | 0.68% | |

| New Zealand dollar | 0.79% | 0.72% | 0.16% | 0.50% | 0.91% | -0.02% | 0.66% | |

| Swiss franc | 0.14% | 0.07% | -0.49% | -0.20% | 0.25% | -0.68% | -0.66% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select USD from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).