On Friday, the US will see the release of the preliminary estimate for the University of Michigan (UoM) Consumer Confidence Index for December. The report is expected to reflect a moderate improvement in consumer confidence, with the University of Michigan Consumer Confidence Index expected to rise to 52 after reaching a three-year low of 51 last month.

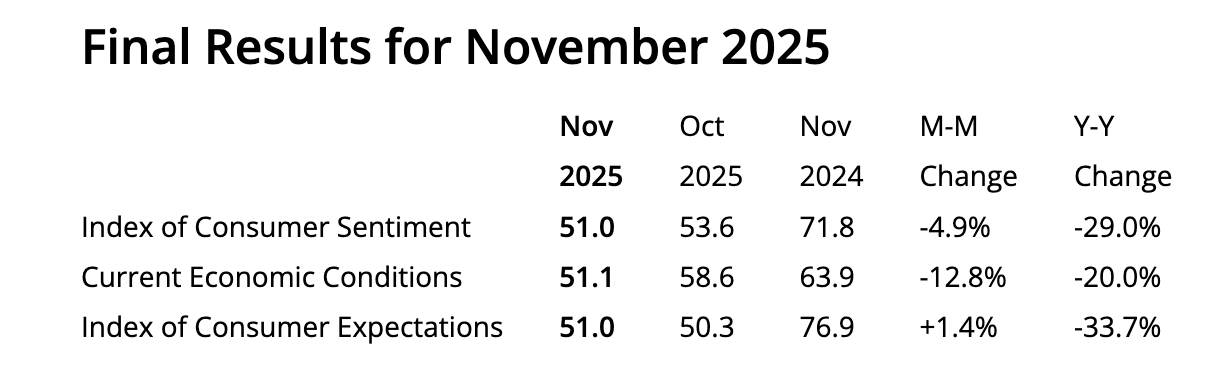

November data also revealed a sharp deterioration in consumers’ views on current economic conditions, with the index falling to 51.1 from 58.6 in October. On the other hand, the economic expectations index improved slightly to 51 from 50.3 in October.

The Consumer Confidence Index is a monthly survey conducted by UoM that collects data on American consumers’ views on their personal finances, business conditions and purchasing plans. The report was unveiled alongside the University of Michigan Consumer Expectations Index and the University of Michigan Consumer Inflation Expectations.

Two weeks later, the University of Michigan will release the final Consumer Confidence Index report.

Household consumption represents about two-thirds of the United States’ gross domestic product. In this sense, the University of Michigan Consumer Confidence Index is an accurate forward-looking indicator of US economic trends, and its release tends to have a significant impact on USD pairs.

The December release will be the first after the US was shut down for a record period, and investors will be keen to see the impact of the government’s reopening, although the market consensus shows no relevant improvement.

A stalled job market and rising prices will likely remain the biggest concerns for U.S. consumers, keeping consumer sentiment in Michigan near historic lows. The expected level of 52 would be an improvement from the 51 level seen in November, but represents a decline of approximately 30% from the reading of 74 seen in December of last year.

The official November report cited rising prices and falling incomes as the main reasons behind deteriorating sentiment: “Consumers remain frustrated by persistently high prices and weak incomes. This month, current personal finances and purchasing conditions for durable goods declined by more than 10%, while expectations for the future improved modestly,” the report says.

Regarding prices, moderate inflationary trends have not eased consumer frustration: “Despite these improvements in the future path of inflation, consumers continue to report that their personal finances are now burdened by the current state of rising prices.”

When will the University of Michigan Consumer Confidence Index be released, and how could it affect the US dollar?

The University of Michigan will release its Consumer Confidence Index, as well as its Consumer Inflation Expectations Survey, on Friday at 15:00 GMT. The market is anticipating a slight improvement in consumer sentiment, although likely not enough to provide a significant boost to the struggling US dollar.

The US dollar was the worst performing currency in the G8 during November. Dovish comments from Federal Reserve officials, coupled with a host of weak macroeconomic indicators, specifically retail sales and manufacturing activity, revived concerns about the US economic momentum and prompted investors to increase bets on a Fed rate cut in December.

Moreover, news that White House economic adviser Kevin Hassett is best positioned to replace Fed Chairman Jerome Powell at the end of his term in May is fueling hopes for further monetary policy easing in 2026.

As the rest of the world’s major central banks reach the end of their easing cycles, the monetary policy divergence with the US Federal Reserve is crushing the US dollar.

According to Guillermo Alcala, Forex Analyst at FXStreet, the US Dollar Index (DXY) broke an important support area at 99.00: “The pair confirmed a double top at the 100.35 area, after breaking the neckline of the pattern near 99.00, which is keeping the bulls in check at the time of writing. Failure to return above this level will increase downward pressure towards the October 28 low at 98.57.” The low of October 17 is near 98.00, and the measured target for the double top is near the low of October 1 and 2, near 97.50.

On the upside, Alcala sees resistance at 99.55 and in the 100.00 area: “Upside attempts are likely to be challenged at the highs of 30 November and 2 December near 99.55 and the psychological 100.00 level, ahead of five-month highs, in the 100.35 area (highs of 5 November and 21 November).”

Economic indicator

Michigan Consumer Confidence Index

Michigan Consumer Confidence Index, released on a monthly basis by University of Michiganis a survey that measures sentiment among consumers in the United States. The questions cover three broad areas: personal finances, working conditions, and terms of purchase. The data shows a picture of whether or not consumers are willing to spend money, which is a key factor because consumer spending is the main driver of the U.S. economy. The survey conducted by the University of Michigan has proven to be an accurate indicator of the future path of the American economy. The survey is published as a preliminary reading in the middle of the month and a final edition at the end of the month. In general, a high reading is considered bullish for the US Dollar (USD), while a low reading is considered bearish.

Read more.

Next release:

Friday 05 December 2025 at 15:00 (before)

repetition:

monthly

consensus:

52

former:

51

source:

University of Michigan

Consumer exuberance could translate into greater spending and faster economic growth, which would imply a stronger labor market and potentially higher inflation, which would help shift the Fed to a hawkish stance. The popularity of this survey among analysts (cited more frequently than CB’s Consumer Sentiment) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but above all because it measures consumers’ attitudes on finances and income. Actual numbers that beat consensus tend to be bullish for the US dollar.

Economic indicator

Michigan Consumer Expectations Index

the University of Michigan Inflation Expectations The measure captures the extent to which consumers expect prices to change over the next 12 months. It’s being rolled out in two rounds – an initial release that tends to offer a larger package, followed by a revised update two weeks later.

Read more.

Next release:

Friday 05 December 2025 at 15:00 (before)

repetition:

monthly

consensus:

–

former:

51

source:

University of Michigan