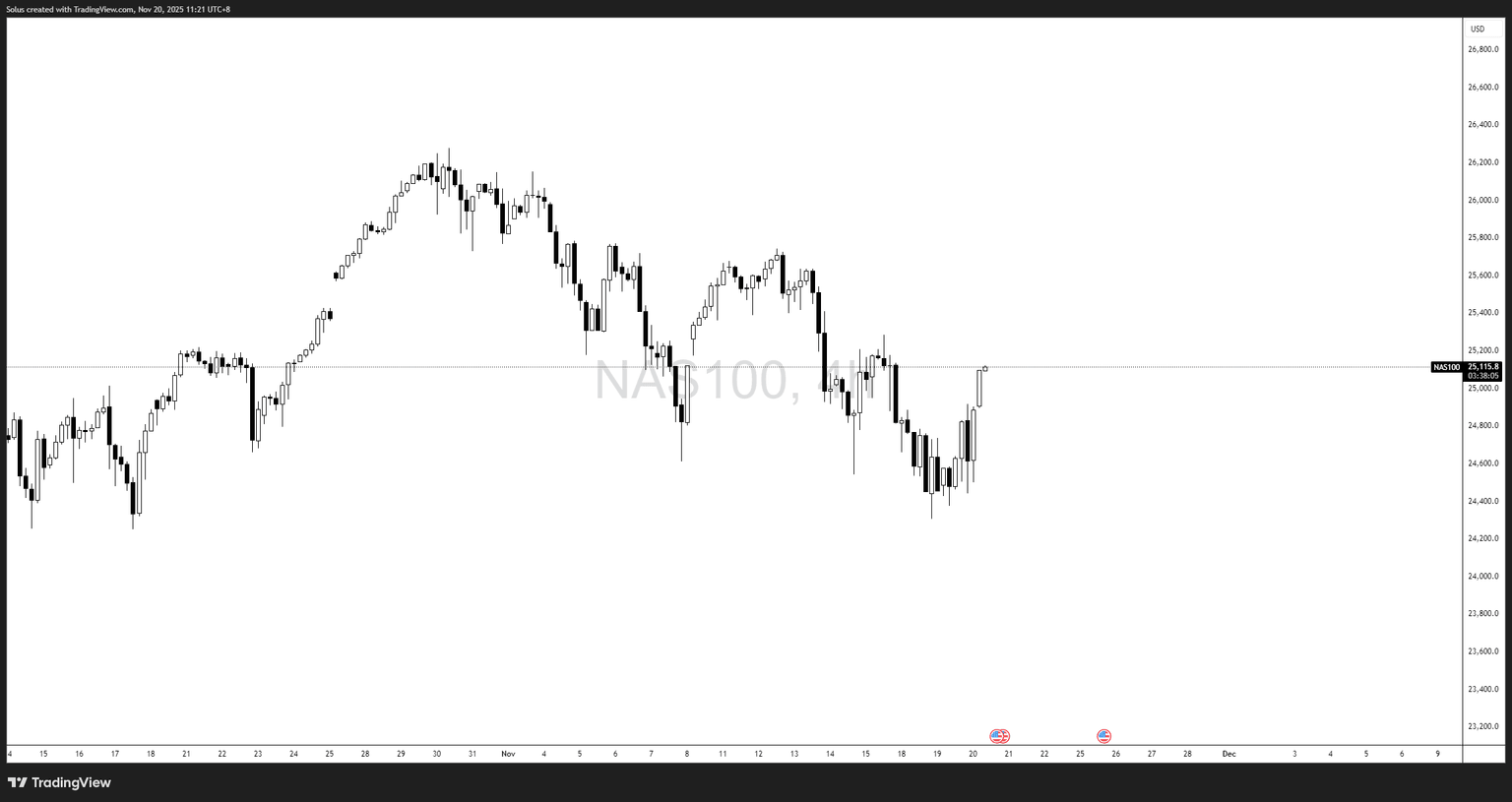

Nasdaq 100 Overview – Performance at a Glance

The Nasdaq 100 has spent the past few sessions recovering strongly from its November lows, bouncing from… 24,307 And climb back to 25,100-25,150 mid-range area. While the candles look convincing, the broader picture reveals a different story: the indicator remains confined within a zone 4H scope structuretrapped between 24,307 (Support) and 25,284 (resistance).

This means that the bounce is impressive, but it still is uncertain. Until the price breaks the high range, the movement remains corrective and not trend-setting.

The question traders are asking now:

Is this the beginning of a real recovery or just another trap inside the box?

Nasdaq strength and weakness narrative

Strengths supporting the rebound

- Strong reaction at 24307

This area continues to hold as strong demand, with a clear desire from buyers to defend the level aggressively. - Stable technical sentiment

Megacap and AI names are seeing renewed bidding, giving the Nasdaq a basis for recovery. - There are no new negative macro catalysts

Despite the government shutdown and delayed US economic releases, there are no new catalysts for risk aversion at the moment.

Weaknesses limit the upside

- The price is still below the resistance level 25,284

This ceiling defines the entire range. Without interruption, the narrative remains neutral. - Corrective structure, not impulsive

The current candles are pushing higher, but not with the momentum usually associated with a trend reversal. - Uncertain macro environment

Fed messaging, liquidity pressures, and data lost due to the shutdown are making institutions hesitant to fully commit.

Taken together, Nasdaq is Strong in the short term, weak in the broader termAnd stuck between confirmation and doubt.

News influence – what drives the current movement

While the micro backdrop to technology strength is helping the recovery, the macro landscape remains murky:

- The Fed’s tone remains pivotal

Slightly tight shifts or concerns about liquidity can quickly halt tech rallies. - Data delay caused by power off

With employment and inflation releases at risk of disruption, traders lack full visibility, forcing them to rely more on sentiment than data. - Risk appetite improves, but with caution

Investors are willing to buy dips but not chase highs without macroeconomic clarity.

This is in line with what we see in the price: Bounce, not breakout yet.

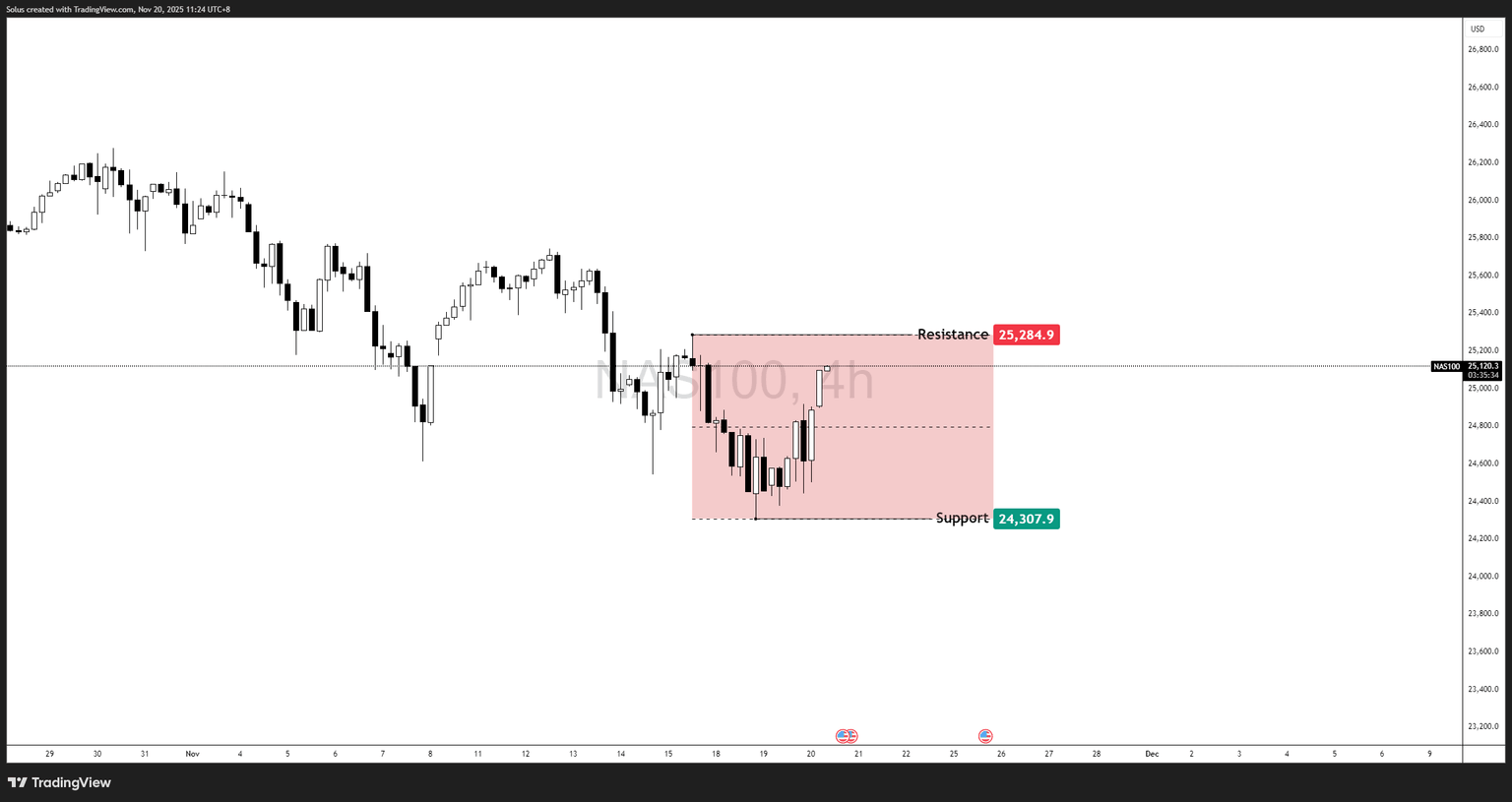

Technical Forecast – Nasdaq 100

Key levels

- resistance: 25,284.9

- Supports: 24,307.9

- Current area: 25100-25150 is average range

The price rotates within a specific consolidation box over a 4-hour period. Your charts clearly show two scenarios: continuation of the bullish breakout or bearish range rotation.

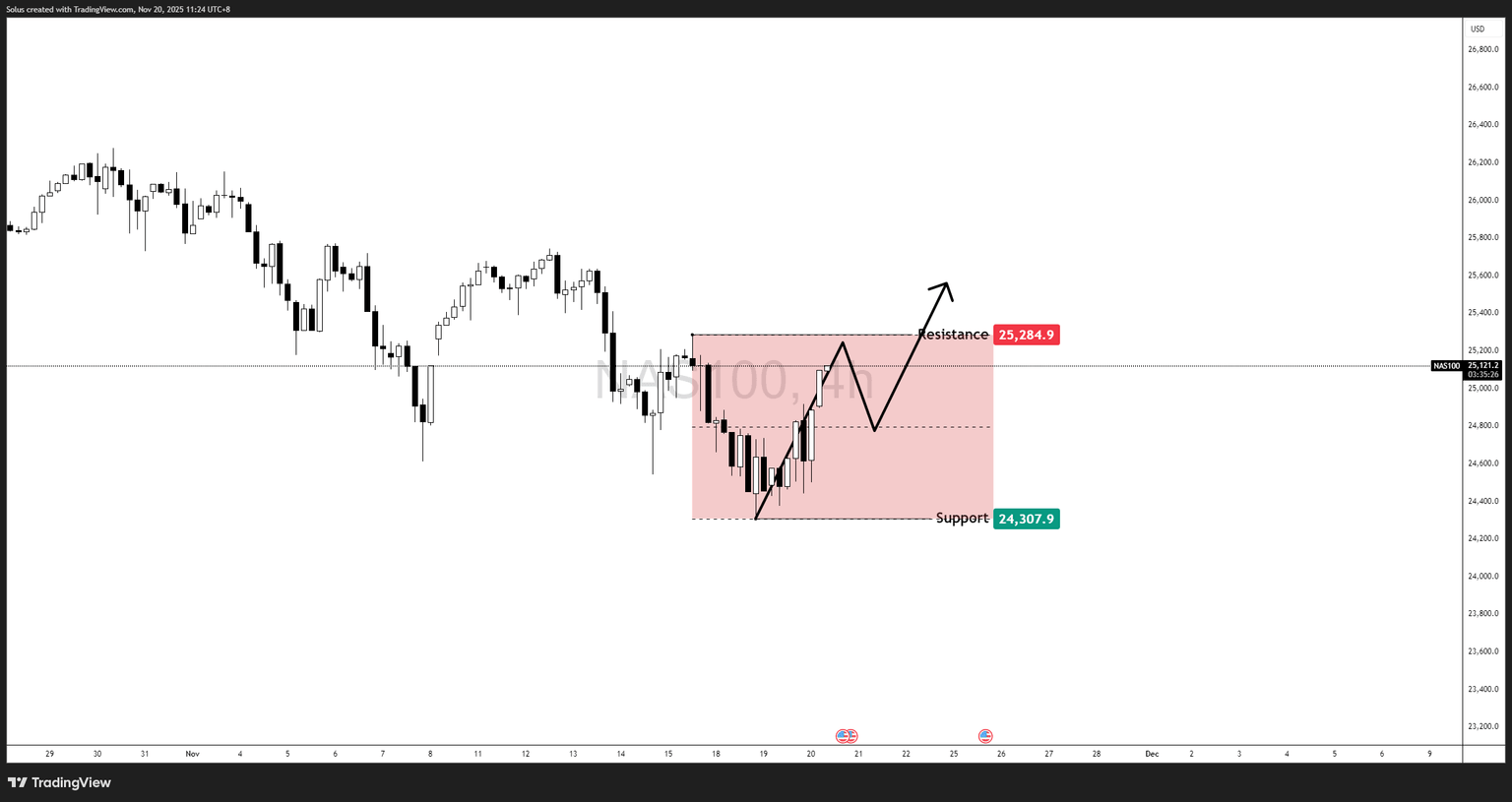

Bullish scenario – break above 25,284 to confirm trend continuation

A bounce becomes a true breakout only if the Nasdaq:

- It breaks and closes above 25,284

- Retest and stability above the level

- Builds higher time frame structure to continue going up

If this happens, the market turns from neutral to bullish with upside potential.

Upside goals

- 25,450 – Inefficiency first

- 25,700-25,800 – Main supply area

- Possible new highs If technological momentum accelerates

According to your notation, a bullish scenario requires confirmation. No breakout = no long bias.

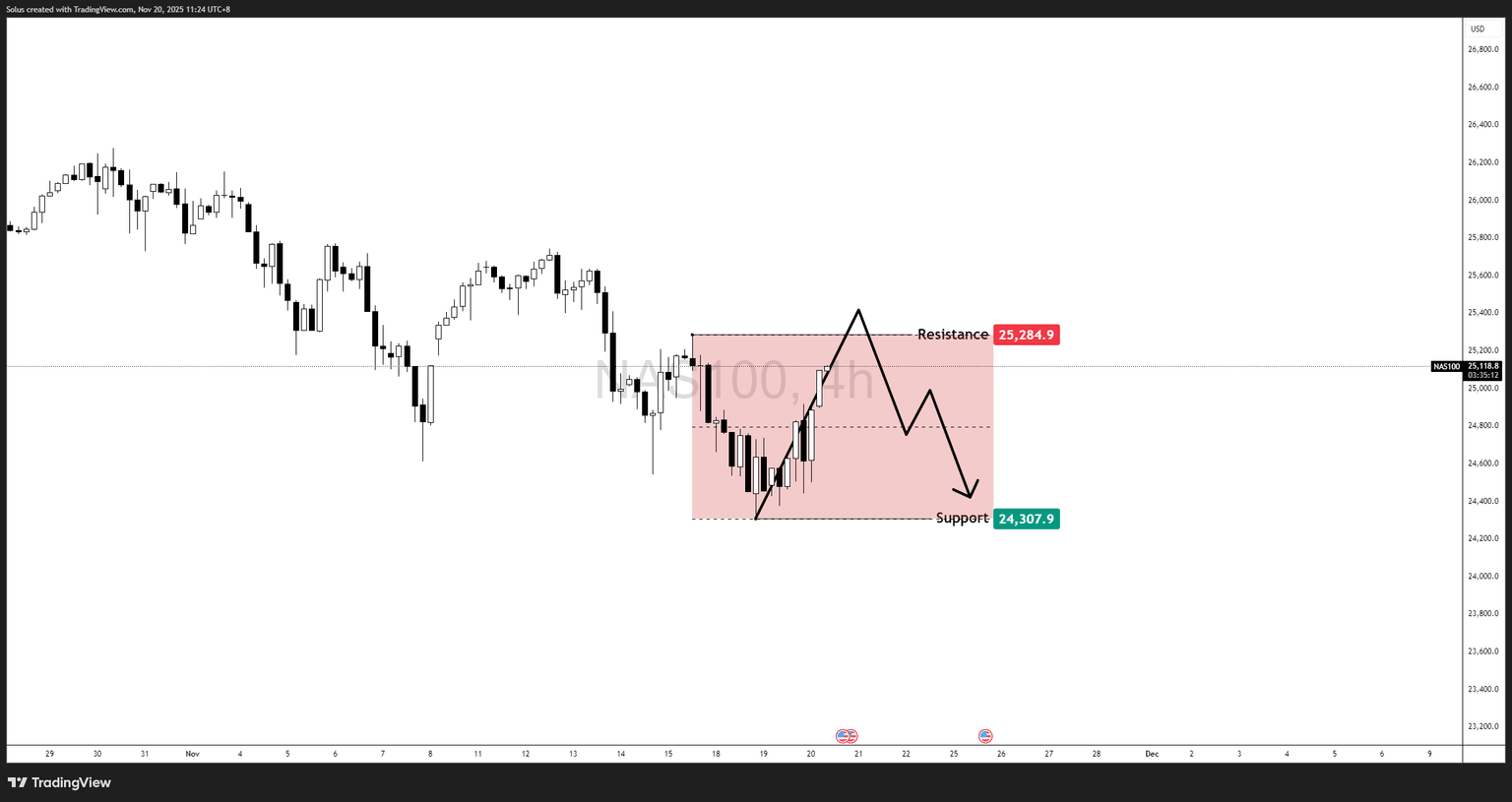

Bearish scenario – failure at 25,284 takes the price back to 24,307

If Nasdaq fails to break resistance:

- Price forms a Lower height

- Momentum stops at the medium term

- The market is moving down towards support

This is in line with your expected downward sweep.

Bearish targets

- 24,850 → 24,600 (Negative sinuses during the day)

- 24,307 – Full range rotation

- 23900-24000 If 24307 fails

This is where the “trap” narrative becomes true – a strong-looking bounce, but still within a range that calls for a complete sweep.

Final thoughts

The Nasdaq 100’s rebound looks impressive, but until then 25,284 breaksIt’s just a matter of bouncing inside the box. The market is balanced, reactive and awaiting confirmation.

- Above 25,284 ← breakout confirmed

- Below 25,000 → an upward push loses momentum

- Return to 24,307 ← Range complete, trap confirmed

For now, traders should treat the NASDAQ as an index Domain marketnot a trending one. Patience and assurance remain the edge.