Netflix shares opened sharply lower this morning, heading towards a key technical support level nearby $83.50despite publication Record quarterly results And issuing optimistic forward guidance. The stock has been under pressure for several weeks, nearly falling 35% from its highest levels in Novemberas investors weigh strong fundamentals against macro uncertainty and looming impact Warner Bros. acquisition.

Earnings Takeaway: Strong print meets cautious bar

You mentioned Netflix Fourth quarter 2025 revenue of $12.05 billionhigher 18% on an annual basisand Net income: $2.4 billiontranslation of Earnings per share $0.56 -Slightly higher than expectations. Operating margin expanded to 25%driven by advertising growth and pricing power, while Advertising revenues increased by 2.5 times For more than $1.5 billion For a whole year.

The full year results were equally impressive:

- FY25 revenues: $45.2 billion (+16% YoY).

- Operating margin: 29.5% (+3 points).

- Free cash flow: $9.5 billion, well above expectations.

By most metrics, Netflix has another win, but investors aren’t cheering.

Forward guidance: Strong, but tempered by acquisition costs

For 2026, Netflix is directed to $50.7 – $51.7 billion in revenue (+12-14% YoY) and A Operating margin 31.5%,except approx $275 million in costs related to Warner Bros. The company expects advertising revenues to reach Double again And projects $11 billion in free cash flow For the year.

However, while growth remains strong,… The pace of margin expansion The moderation is taking place as Netflix reinvests in content, live events and games. The market may also adjust in the short term Pause in stock buybacks And the $40 billion+ bridge facility associated with An all-cash transaction for Warner Bros.

Simply put, Netflix’s fundamentals remain strong – but investors appear uneasy about execution and capital allocation risks during this pivotal merger phase.

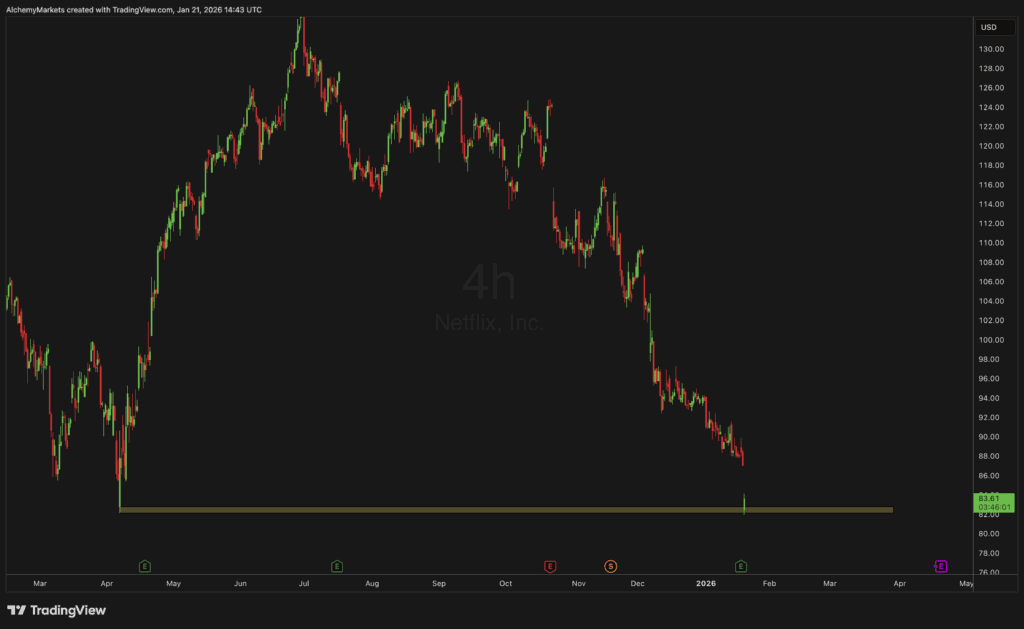

Technical View: Sitting at monetary support

As of this morning, shares are hovering around $83.50It is the same level that distinguished him Breakout base may 2025. The stock has been on a sustained downtrend since late summer, breaking key support areas around $100 and $90.

on 4 hour chartTrading volume rose at the open as traders defended the $83-84 area – a sign of potential Short-term stability. This area represents the last major accumulation level before the deeper bounce towards… $75.

Setup: Bounce or Breakdown?

Given to Core strength and Forward revenue visionIn the near term Technical bounce From this support level it looks likely – especially if buyers step in following the earnings overreaction. But the broader trend remains fragile.

If $83 fails to hold on a closing basis, technical models point to a possibility Breakdown towards $78-$80Where the long-term moving averages converge. On the contrary, there is a sustained recovery above $90 Sentiment can be reset and bottom confirmed.

Bottom line

Netflix’s Q4 printing was strong, and its guidance points to continued profitable growth. However, as investors’ focus shifts to… Acquisition financing, Margin headwindsand Evaluation pressureEmotions turned defensive.

The next few sessions will be crucial: Either buyers defend this support — signaling confidence in Netflix’s growth story — or a clean break lower could open the door to deeper technical weakness before the merger timeline becomes clear.