NZD/USD is trading 0.25% higher near 0.5770 during the early European trading session on Monday. The New Zealand pair is regaining strength after revisiting its lowest level in almost three weeks near 0.5736 on Friday amid improving risk sentiment.

However, the uptrend in the New Zealand Dollar (NZD) appears to have stalled as market expectations for a Reserve Bank of New Zealand (RBNZ) rate hike have diminished, despite better-than-expected Q3 New Zealand GDP data.

The likelihood of the Reserve Bank of New Zealand raising the official cash rate (OCR) at its July 2026 meeting has narrowed to 40% from 50% seen before the release of third-quarter GDP data.

Stats NZ reported on Thursday that the economy grew at a faster pace of 1.1% compared to estimates of 0.9%. In the second quarter, the economy fell by 1%.

Meanwhile, a slight corrective move in the US dollar also strengthened the New Zealand pair. The US Dollar Index (DXY) is trading slightly lower near 98.60, even as traders remain confident that the Federal Reserve (Fed) will not cut interest rates in its January policy meeting.

Technical analysis of the New Zealand dollar

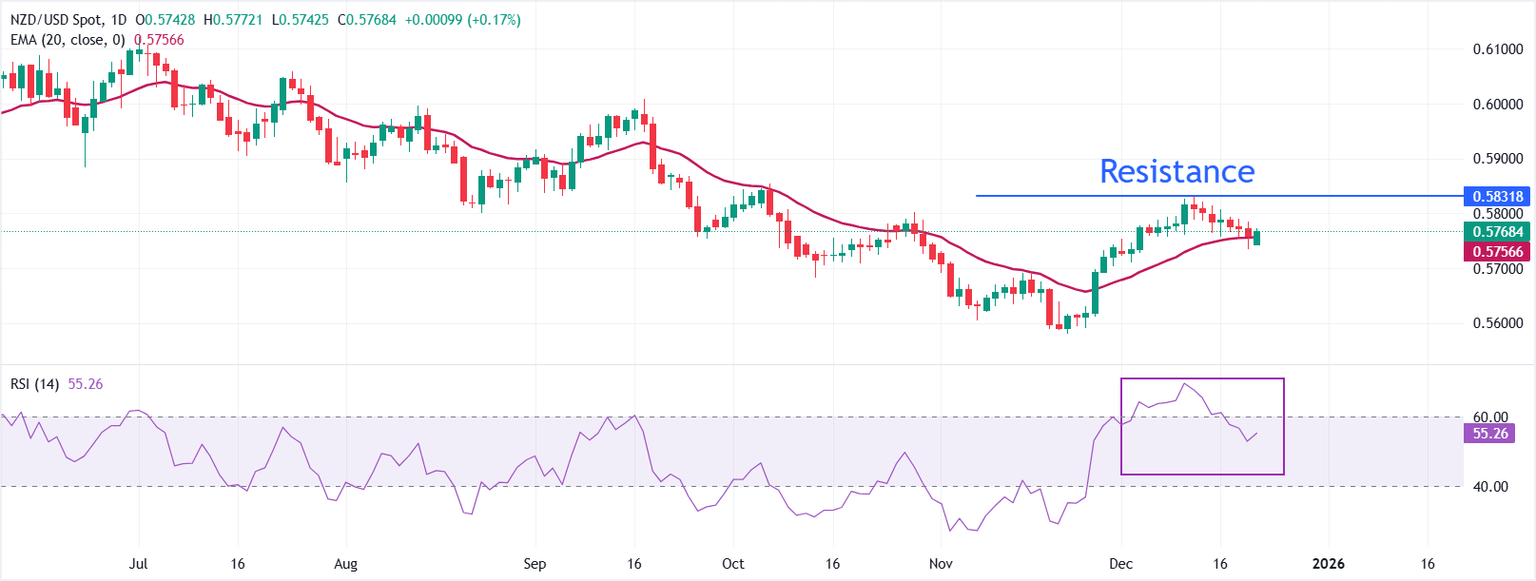

NZD/USD is trading higher around 0.5769 at the beginning of the week. The pair is holding above the 20-day exponential moving average (EMA) at 0.5757, maintaining a short-term bullish bias. The 20-day EMA has been trending higher for several sessions, and continues to support declines. The RSI at 55 (neutral) is moving higher, maintaining somewhat positive momentum.

Continued stability above the 20-day EMA should keep the recovery intact. The way will be opened for further gains if the price breaks the December 11 high of 0.5832. The price may lose its strength if it breaches the lowest level recorded on Friday at 0.5735.

With the Relative Strength Index (RSI) near 60 and far from overbought territory, the bulls have room to push higher. A pullback towards the 50 midline would herald a loss of momentum.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Economic indicator

GDP (Quarterly)

GDP, issued by Statistics New Zealand On a quarterly basis, it is a measure of the total value of all goods and services produced in New Zealand during a given period. GDP is the main measure of economic activity in New Zealand. The quarterly reading compares economic activity in the reference quarter with the previous quarter. In general, a high reading is considered bullish for the New Zealand Dollar (NZD), while a low reading is considered bearish.

Read more.

Latest version:

Wednesday 17 December 2025 at 21:45

repetition:

Quarterly

actual:

1.1%

consensus:

0.9%

former:

-0.9%

source:

Statistics NZ

GDP, released by Statistics New Zealand, highlights overall economic performance on a quarterly basis. The gauge has a significant impact on the monetary policy decision of the Reserve Bank of New Zealand (RBNZ), which in turn affects the New Zealand dollar. An increase in the GDP rate indicates improving economic conditions, which calls for tightening monetary policy, while a decrease indicates a deterioration in activity. A higher than expected GDP reading is seen as bullish for the New Zealand dollar.