The pound sterling attracts bids against major currencies and jumps 0.45% to approach 1.3440 on Monday, after the release of third-quarter GDP data in the UK. The Office for National Statistics (ONS) confirms that the economy grew at a quarterly rate of 0.1%, in line with initial estimates.

On an annual basis, the UK economy also grew by 1.3%, preliminary data showed.

The impact of the revised third-quarter GDP numbers on the British currency is expected to be short-lived, while investors remain concerned about how the economy will perform in the final quarter of the year.

Last week, the Bank of England (BoE) said in its monetary policy statement that staff expect “zero GDP growth for the fourth quarter”, after cutting the interest rate by 25 basis points to 3.75% by 5 votes to 4. In October, the economy surprisingly fell by 0.1%, data showed earlier this month.

Going forward, the main driver of the British pound will be market expectations of the Bank of England’s monetary policy outlook amid a light economic calendar week. In its monetary policy announcement on Thursday, the Bank of England reiterated that its interest rate path would remain “gradual.”

The price of the British pound today

The table below shows the percentage change of the British Pound (GBP) against the major currencies listed today. The British pound was the strongest against the US dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.19% | -0.33% | -0.16% | -0.20% | -0.44% | -0.43% | -0.23% | |

| euro | 0.19% | -0.15% | 0.04% | 0.04% | -0.28% | -0.24% | -0.04% | |

| GBP | 0.33% | 0.15% | 0.19% | 0.17% | -0.13% | -0.09% | 0.11% | |

| JPY | 0.16% | -0.04% | -0.19% | -0.02% | -0.28% | -0.25% | -0.06% | |

| Canadian | 0.20% | -0.04% | -0.17% | 0.02% | -0.25% | -0.24% | -0.03% | |

| Australian dollar | 0.44% | 0.28% | 0.13% | 0.28% | 0.25% | 0.02% | 0.22% | |

| New Zealand dollar | 0.43% | 0.24% | 0.09% | 0.25% | 0.24% | -0.02% | 0.20% | |

| Swiss franc | 0.23% | 0.04% | -0.11% | 0.06% | 0.03% | -0.22% | -0.20% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the British pound from the left column and move along the horizontal line to the US dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The British pound outperforms the US dollar ahead of the third quarter US GDP data

- The British pound rose 0.45% to approach 1.3440 against the US dollar during the European trading session on Monday. GBP/USD rose as the US dollar faces slight pressure, with investors turning cautious ahead of preliminary US third-quarter GDP data due on Tuesday.

- At the time of writing, the US Dollar Index (DXY), which tracks the value of the dollar against six major currencies, is trading 0.25% lower near 98.50.

- Investors will pay close attention to US GDP data for new signals about the current state of the economy. The numbers are expected to show that the US economy grew at an annual rate of 3.2%, moderately from 3.8% in the second quarter.

- Signs of slowing US GDP growth may force traders to scale back bets supporting further interest rate cuts by the Federal Reserve in the near term.

- Currently, there is a 22.5% chance that the Fed will cut interest rates by 25 basis points to 3.25%-3.50% at its January meeting, the CME FedWatch tool shows.

- The Fed’s dovish outlook remains muted even as US CPI data for November on Thursday showed price pressures grew moderately. As measured by the CPI, headline and core inflation fell to 2.7% and 2.6% year-on-year, respectively.

- Over the weekend, Cleveland Fed President Beth Hammack said in a radio interview with The Wall Street Journal (WSJ) that interest rates should remain at current levels until at least the spring, adding that the latest inflation data has been distorted by the Fed shutdown.

Technical Analysis: GBP/USD is witnessing further rise above 1.3500

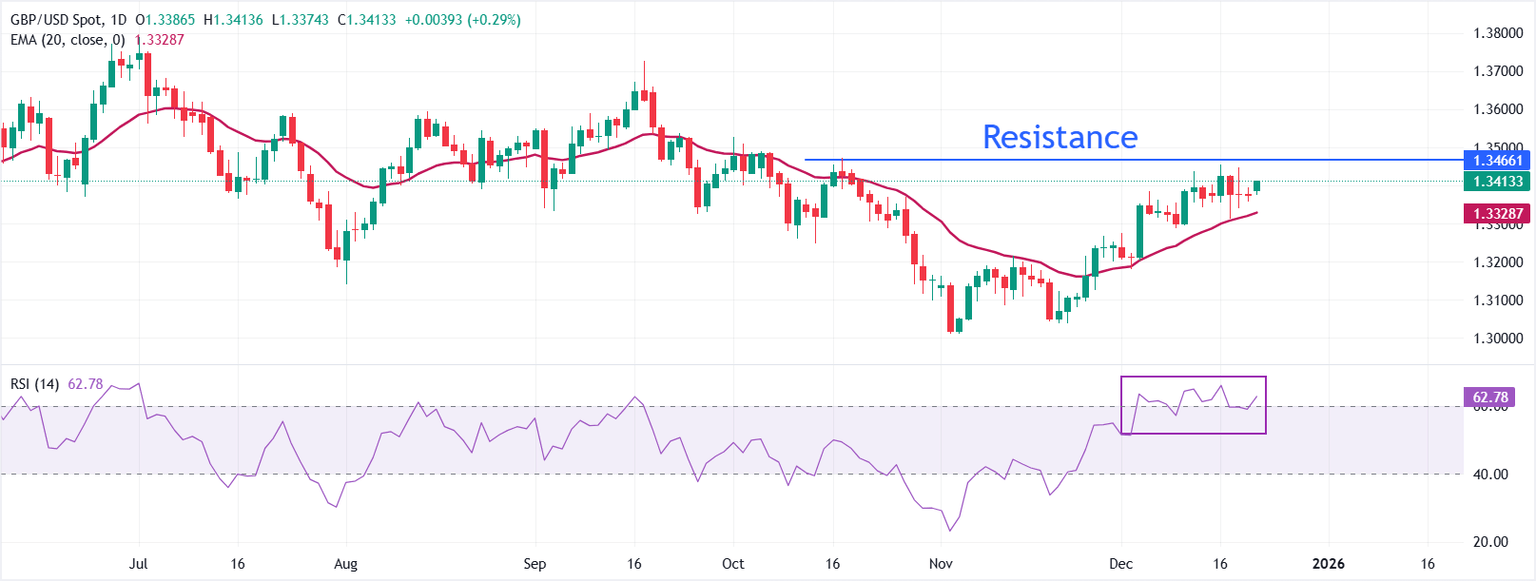

The GBP/USD pair is trading at 1.3415 at the beginning of the week. The 20-day Exponential Moving Average (EMA) is sloping upward, reinforcing the bullish bias as the price maintains a clear premium above the average. Sustained stability above the 20-day EMA at 1.3329 keeps the outlook intact.

The 14-day Relative Strength Index (RSI) at 62.89 confirms strong momentum below overbought signals.

Pullbacks can be accommodated by buying on dips near the 20-day EMA, while the broader trend favors continuation. Looking to the upside, the pair may consolidate on a decisive break above the horizontal resistance drawn from the October 17 high at 1.3471.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)