The British pound rose 0.15% to approach 1.3400 against the US dollar during the European trading session on Monday. GBP/USD rises as the US dollar (USD) underperforms across the board amid disagreements between the United States (US) and the European Union (EU) over Washington’s desire to buy Greenland.

At press time, the US Dollar Index (DXY), which measures the value of the US currency against six major currencies, was down 0.2% to close to 99.15.

Over the weekend, US President Donald Trump announced 10% tariffs on several European Union members through a post on Truth. “The national security of the United States and the entire world is at stake,” Social added. Trump stated that the additional tariffs will go into effect on February 1 and will remain in place until Washington makes a “full and complete purchase” of Greenland.

In response, EU members criticized the new tariff threats from Washington, calling them “unwanted” and vowing to take similar countermeasures. The British Broadcasting Corporation (BBC) quoted French President Emmanuel Macron as saying, “Threats to impose customs duties are unacceptable in this context, and we will not be affected by any intimidation.”

Analysts at ANZ said the US dollar is bearing the brunt of US-EU disputes as markets price a “heightened political risk premium” onto the US dollar.

US dollar price today

The table below shows the percentage change in the US Dollar (USD) against the major currencies listed today. The US dollar was the weakest against the Swiss franc.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.24% | -0.22% | -0.11% | -0.21% | -0.22% | -0.44% | -0.52% | |

| euro | 0.24% | 0.02% | 0.15% | 0.04% | 0.03% | -0.19% | -0.27% | |

| GBP | 0.22% | -0.02% | 0.15% | 0.02% | 0.00% | -0.21% | -0.31% | |

| JPY | 0.11% | -0.15% | -0.15% | -0.12% | -0.12% | -0.34% | -0.44% | |

| Canadian | 0.21% | -0.04% | -0.02% | 0.12% | -0.01% | -0.22% | -0.32% | |

| Australian dollar | 0.22% | -0.03% | -0.01% | 0.12% | 0.00% | -0.23% | -0.32% | |

| New Zealand dollar | 0.44% | 0.19% | 0.21% | 0.34% | 0.22% | 0.23% | -0.10% | |

| Swiss franc | 0.52% | 0.27% | 0.31% | 0.44% | 0.32% | 0.32% | 0.10% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select USD from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily Summary Market Movers: Fed’s Bowman supports further interest rate cuts

- The pound is trading higher against the US dollar, but lower against its major counterparts, with US President Trump also threatening 10% tariffs on the UK amid US-EU disputes over Greenland.

- In response, British Prime Minister Keir Starmer stated that “tariffs are not the right way forward and should not be used against allies.” Starmer added: “We believe in partnership and will keep the dialogue open.”

- Going forward, the pound is expected to continue to be volatile amid a data-packed week in the UK, starting with employment figures for the three months to November due out on Tuesday.

- Investors will pay close attention to UK labor market data for new signals on the Bank of England’s (BoE) monetary policy outlook. The ILO unemployment rate is expected to show a decline to 5% from 5.1% in the three months to November, the highest level since early 2021. Average earnings including bonuses are expected to fall to 4.6% from the previous reading of 4.7%.

- Other key releases this week are the UK Consumer Price Index (CPI) and retail sales figures for December, and preliminary global Purchasing Managers’ Index (S&P) data for January.

- In the US, traders remain confident that the Federal Reserve will keep interest rates steady at its next monetary policy meeting in January, according to the CME FedWatch tool. However, Fed Vice Chair for Supervision Michelle Bowman said Friday that the Fed should be prepared to cut interest rates further amid fragile labor market conditions.

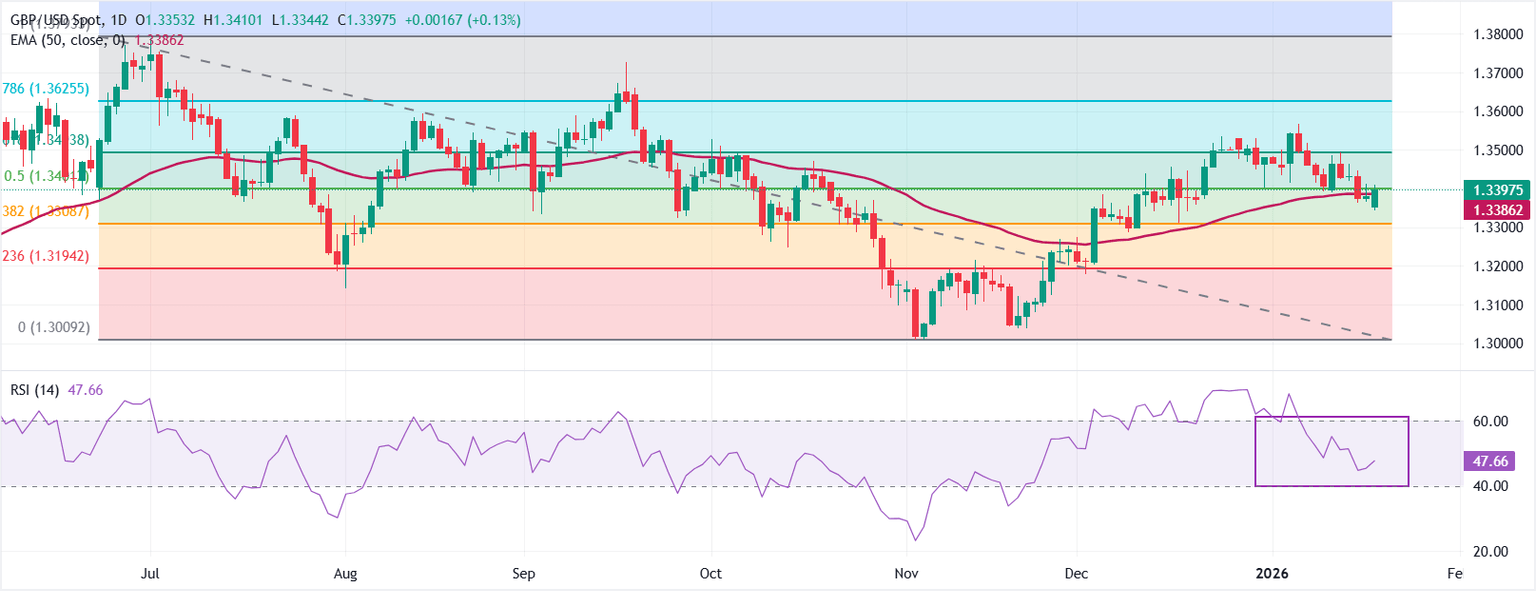

Technical Analysis: GBP/USD is struggling around the 50-day EMA

GBP/USD is trading slightly higher at 1.3397 as of writing. The price holds above the 50 Exponential Moving Average (EMA) at 1.3386, maintaining support for the short-term tone.

The 14-day Relative Strength Index (RSI) at 48 (neutral) reflects moderate momentum after the recent pullback.

Measured from the high of 1.3793 to the low of 1.3009, the 50% Fibonacci retracement levels at 1.3401 are heading towards an immediate uptrend. A decisive recovery move above the same level could push the price towards the 61.8% Fibonacci retracement level at 1.3494. Conversely, a close below the 38.2% Fibonacci retracement level at 1.3309 would extend the decline towards the December low at 1.3180.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Economic indicator

Average earnings including bonus (3 months/year)

Average earnings including bonus, issued by the UK office National statisticsis a leading short-term indicator of how wage levels are changing within the UK economy. Generally, an increase in earnings is viewed as bullish for the British Pound (GBP), while a lower reading is viewed as bearish.

Read more.

Next release:

Tuesday 20 January 2026 at 07:00

repetition:

monthly

consensus:

4.6%

former:

4.7%

source:

Office for National Statistics