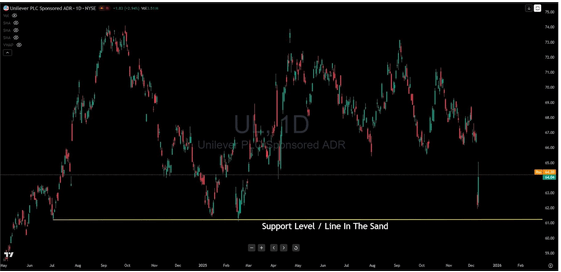

Unilever PLC (UL), the multinational consumer goods company behind brands like Dove, Hellmann’s, and Ben & Jerry’s, provided one of those chart moments that separate patient traders from impulsive traders. After falling violently from the $71 range, shares fell to test a support level tested throughout 2024 and into 2025 – the $61 area. Right now, the stock is fighting back, trading around $64.78, but the real question is whether this rebound has legs or is just another false start.

Let’s uncover what makes this setup noteworthy.

UL Trusted Floor $61

This horizontal yellow line at $61 is the main area I’m watching. This has been the minimum price movement at Unilever for nearly two years. Going back to March 2024, buyers intervened aggressively at this level. Fast forward to December 2024 – same story. Now, in December 2025, we see another close test of this area with prices rising sharply. When a level is maintained at this level several times, it becomes a psychological bedrock for both institutions and retailers. The chart’s caption calls it a “line in the sand,” and that’s exactly what it represents: a make-or-break threshold where Unilever defends its territory or succumbs to deeper selling pressure.

The recent sell-off has been sharp and uncomfortable, the kind that shakes weak hands and tests condemnation. But notice how quickly the price reversed just above the $61 support level? This is not the behavior of a stock ready to collapse. It indicates that buying interest remains at these levels.

Bounce: Real power or fake head?

Unilever has recovered approximately $3 to $4 from the bottom, and the nature of this recovery is important. The bounce was decisive, not the slow recovery we see when buyers lack conviction. For those monitoring momentum, this could indicate the early stages of a legitimate reversal setup – assuming $61 continues as a basis.

The bullish case is clear and straightforward: If UL can maintain support above $64 and build on this momentum, the next logical targets are in the $68-70 range, where previous consolidation areas could act as resistance. Traders looking to take a position on the long side could consider entering on any pullback towards $63-64, using a stop below $61 to determine risk. This support level is your invalidation point. If it breaks, the artistic thesis collapses.

Bear Case: One break changes everything

But let’s not get ahead of ourselves. Support levels, no matter how historically significant, are not impenetrable walls. They are probabilities, not certainties. If Unilever fails to sustain this bounce and falls again to retest the $61 level with low momentum or high volume, that would raise serious red flags. A confirmed break below $61 would likely trigger a series of stops and possibly open the door to the $58-59 area or lower, where the next layer of demand may exist.

Bears watching this setup will be looking for failed highs – a price that struggles to reclaim $66-67 before pulling back. Any inability to build on this bounce may indicate that distribution is still under control, and short traders may find opportunities on weakness towards the support level.

What are you watching next?

The technical narrative here is clear: Unilever is at a pivotal moment. The $61 support has held through multiple challenges, and the recent bounce suggests that buyers are not ready to abandon ship. But until the price can recover and hold above the $67-68 area, this remains a “prove it” situation.

For swing traders, this is a risk-defining setup. Long trades with stops below $61 provide a clear trade structure, while the bears need to see this bounce fail before committing capital to the short side. Either way, that yellow line at $61 will tell you everything you need to know about what’s next for Unilever. Will the consumer giant hold its ground, or is this support level about to become resistance? The market is about to deliver its verdict.