The USD/CAD pair is trading marginally higher around 1.3850 during the European trading session on Wednesday. The Canadian pair is consolidating as investors await the monetary policy of the Bank of Canada (BoC) and the Federal Reserve (Fed), which will be announced later today.

The Bank of Canada is expected to keep interest rates steady at 2.25% as recent Canadian employment data showed signs of strong job creation in the September-November period, following layoffs in July and August.

Meanwhile, the Fed is almost certain to cut the federal funds rate by 25 basis points to 3.50%-3.75% amid weak labor market conditions in the US. The Fed’s policy highlight will be its new 2026 monetary policy guidance.

According to the CME FedWatch tool, there is a 58% chance that the Fed will cut borrowing rates at least twice through October 2026.

Ahead of the Fed’s monetary policy, the US Dollar Index (DXY), which tracks the value of the US currency against six major currencies, fell 0.1% to 99.10.

US dollar price today

The table below shows the percentage change in the US Dollar (USD) against the major currencies listed today. The US dollar was the weakest against the Swiss franc.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.13% | -0.10% | -0.05% | 0.04% | -0.10% | -0.05% | -0.14% | |

| euro | 0.13% | 0.03% | 0.07% | 0.18% | 0.02% | 0.08% | -0.01% | |

| GBP | 0.10% | -0.03% | 0.04% | 0.14% | -0.01% | 0.05% | -0.04% | |

| JPY | 0.05% | -0.07% | -0.04% | 0.10% | -0.05% | -0.01% | -0.09% | |

| Canadian | -0.04% | -0.18% | -0.14% | -0.10% | -0.14% | -0.11% | -0.18% | |

| Australian dollar | 0.10% | -0.02% | 0.00% | 0.05% | 0.14% | 0.06% | -0.03% | |

| New Zealand dollar | 0.05% | -0.08% | -0.05% | 0.01% | 0.11% | -0.06% | -0.09% | |

| Swiss franc | 0.14% | 0.01% | 0.04% | 0.09% | 0.18% | 0.03% | 0.09% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select USD from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

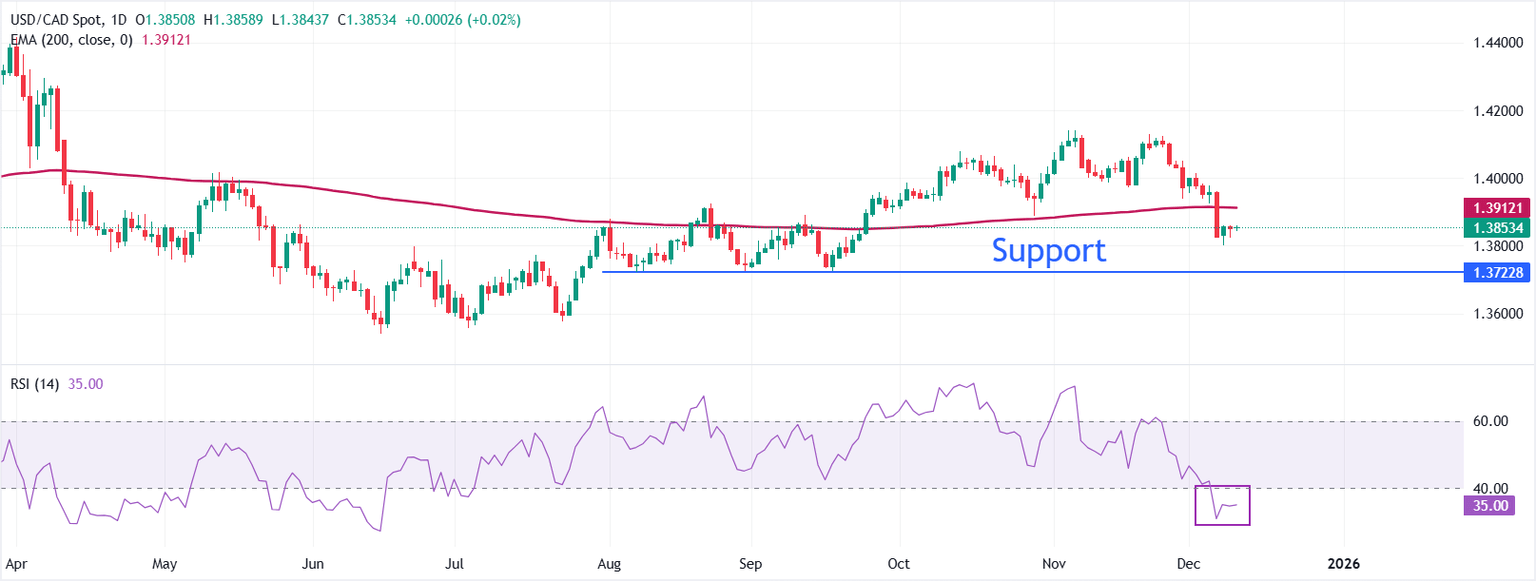

Daily chart of the USD/CAD pair

The USD/CAD pair is trading near 1.3850 during the European trading session on Wednesday. The pair remained below the 200-day EMA at 1.3912, keeping the bears in control. The 200-day moving average has stabilized after an earlier rise, indicating a decline in trend strength. Failure to reclaim the 200-day moving average will continue to put pressure on the downside.

The 14-day Relative Strength Index (RSI) remains at 35 (bearish) above the oversold zone, indicating weak upward momentum.

Below the 200-day EMA, the path of least resistance remains lower, with rallies capped by this dynamic barrier. A daily close above the average would neutralize the immediate bearish tone and open the door for a broader recovery towards the December 4 high at 1.3977. The RSI would need to reclaim the 50 level to validate the improvement in momentum. On the downside, the August 7 low at 1.3720 will remain a key demand area.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Economic indicator

Federal interest rate decision

the Federal Reserve The Federal Reserve deliberates on monetary policy and decides on interest rates at eight pre-scheduled meetings annually. It has two mandates: keeping the inflation rate at 2%, and maintaining full employment. Its main tool for achieving this end is setting interest rates – at which banks lend and banks lend to each other. If it decides to raise interest rates, the US dollar (USD) tends to strengthen because it attracts more foreign capital inflows. If they lower interest rates, they tend to weaken the US dollar while draining capital to countries that offer higher returns. If interest rates are left unchanged, attention turns to the tone of the FOMC statement, and whether it is hawkish (expecting interest rates to rise in the future), or dovish (expecting interest rates to fall in the future).

Read more.

Next release:

Wednesday 10 December 2025 at 19:00

repetition:

irregular

consensus:

3.75%

former:

4%

source:

Federal Reserve