The Indian Rupee (INR) starts the week lower against the US Dollar (USD), extending its losing streak for a third trading day. The USD/INR pair is refreshing its all-time high near 91.10 as the continuous inflow of foreign funds from the Indian stock market amid the absence of any announcement of a trade deal between the US and India is constantly hurting the Indian Rupee.

The United States and India have yet to reach a consensus, even with US Trade Representative Jamieson Greer saying last week that New Delhi’s latest offer was the “best ever” Washington had seen.

So far in December, foreign institutional investors (FIIs) have remained net sellers on all trading days, offloading stake worth Rs. Rs 19,605.51 crore.

Domestically, India’s November Wholesale Price Index inflation data came in better than expected. The data showed that inflation at the producer level contracted at a moderate pace of 0.32% on an annual basis, compared to estimates of 0.6% and a decline of 1.21% in October.

Last week, India’s retail CPI rose 0.71% year-on-year, as expected, from 0.25% in October. However, it is still well below the Reserve Bank of India’s (RBI) tolerance band of 2% to 6%, keeping the door open for further interest rate cuts.

Earlier this month, the Reserve Bank of India also cut the repo rate by 25 basis points to 5.25% and maintained a neutral stance on monetary policy outlook.

The table below shows the percentage change in the Indian Rupee (INR) against the major currencies listed today. The Indian rupee was the weakest against the Japanese yen.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | Indian rupee | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | 0.01% | -0.02% | -0.50% | -0.04% | 0.00% | 0.13% | -0.01% | |

| euro | -0.01% | -0.04% | -0.53% | -0.05% | -0.00% | 0.15% | -0.02% | |

| GBP | 0.02% | 0.04% | -0.48% | -0.02% | 0.03% | 0.16% | 0.01% | |

| JPY | 0.50% | 0.53% | 0.48% | 0.45% | 0.50% | 0.66% | 0.49% | |

| Canadian | 0.04% | 0.05% | 0.02% | -0.45% | 0.05% | 0.19% | 0.03% | |

| Australian dollar | -0.01% | 0.00% | -0.03% | -0.50% | -0.05% | 0.14% | -0.05% | |

| Indian rupee | -0.13% | -0.15% | -0.16% | -0.66% | -0.19% | -0.14% | -0.17% | |

| Swiss franc | 0.00% | 0.02% | -0.01% | -0.49% | -0.03% | 0.05% | 0.17% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily summary of market drivers: Investors await US non-farm payrolls data for November

- The Indian rupee continues to underperform the US dollar, even as the latter remains on guard amid expectations that the Federal Reserve (Fed) will deliver more interest rate cuts next year than it indicated in its monetary policy announcement on Wednesday.

- At the time of writing, the US Dollar Index (DXY), which tracks the value of the dollar against six major currencies, was struggling near an eight-week low of 98.13 hit on Thursday.

- According to the CME FedWatch tool, there is a 64.3% chance that the Fed will cut interest rates at least twice by the end of 2026. While the Fed’s bullet chart showed that policymakers expect the federal funds rate to fall to 3.4% by 2026, suggesting another rate cut from current levels of 3.50%-3.75%.

- The Fed’s cautious bets for next year support strong hopes that Chairman Jerome Powell will be replaced by US President Donald Trump’s nominee, whose decisions will be biased towards Trump’s economic agenda.

- US President Trump has criticized Fed Chairman Powell several times for keeping interest rates at higher levels since his return to the White House. Trump said last week that he was happy with the Fed easing monetary conditions, but he wanted more of it.

- Meanwhile, a Wall Street Journal (WSJ) report on Friday showed that US President Trump is leaning toward either former National Economic Council Director Kevin Hassett or Federal Reserve Governor Kevin Warsh to replace Chairman Powell this year. “I think you have Kevin and Kevin. Both of them – I think Kevin is great,” Trump said.

- Domestically, investors will pay close attention to US nonfarm payrolls data for November, which will be released on Tuesday. Investors will pay close attention to the US NFP data as it will have a significant impact on market expectations of the Fed’s monetary policy outlook, knowing that weak labor market conditions have largely led to interest rates falling by 75 basis points this year.

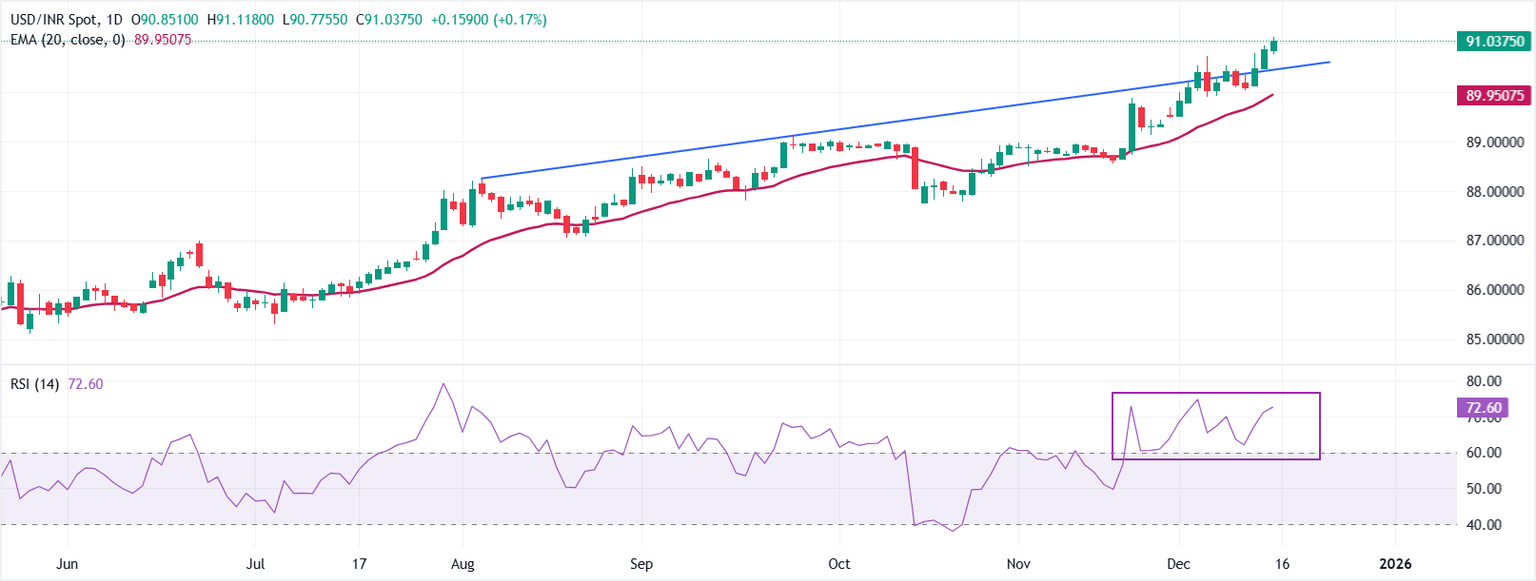

Technical Analysis: The USD/INR pair rose above 91.00

The USD/INR pair is trading higher around the 90.94 level on Monday. The 20 Exponential Moving Average (EMA) is rising at 89.9414 and the price is holding above it, keeping the short-term trend pointing upward. The rising trend line from 88.64 supports the uptrend.

The 14-day RSI at 71.70 is in overbought territory, which could limit near-term gains as momentum extends.

The rising average should act as first support on dips, while a daily close below it would indicate a deeper correction towards the round figure at 90.00. While continued strength above the current level would extend the advance towards 92.00.

(Technical analysis of this story was written with the help of an artificial intelligence tool)