The Indian Rupee (INR) underperformed all its major peers and hit a new low against the US Dollar (USD) after a flat opening at the beginning of the week. USD/INR jumps to near 90.00 as the Indian rupee struggles to attract bids, with continued foreign inflows offsetting the impact of India’s strong GDP growth in the third quarter.

Foreign institutional investors (FIIs) have turned into net sellers in the last five months starting from July, offloading their stakes in the Indian stock market worth Rs. 1,49,718.16 crore.

The currencies of developing economies are greatly affected by the decline in foreign investors’ confidence in their economies.

India’s statistics ministry reported on Friday that the economy expanded at a robust pace of 8.2% year-on-year in the third quarter of the year, faster than expectations of 7.3% and the previous reading of 7.8%. This was the fastest growth seen in more than six quarters.

Market experts have credited the government’s announcements of lower direct and indirect taxes that led to strong consumer spending in the third quarter, and are mixed on whether the Reserve Bank of India (RBI) will cut the repo rate in its next monetary policy announcement on Friday.

Economists at Citibank expect the Reserve Bank of India to leave interest rates unchanged this week, moving away from the agreed-upon call for a 25 basis point cut in interest rates.

The table below shows the percentage change in the Indian Rupee (INR) against the major currencies listed today. The Indian rupee was the weakest against the Japanese yen.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | Indian rupee | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.09% | 0.22% | -0.47% | 0.10% | 0.05% | 0.27% | -0.05% | |

| euro | 0.09% | 0.32% | -0.33% | 0.19% | 0.15% | 0.36% | 0.05% | |

| GBP | -0.22% | -0.32% | -0.62% | -0.13% | -0.17% | 0.04% | -0.27% | |

| JPY | 0.47% | 0.33% | 0.62% | 0.51% | 0.47% | 0.64% | 0.36% | |

| Canadian | -0.10% | -0.19% | 0.13% | -0.51% | -0.05% | 0.17% | -0.15% | |

| Australian dollar | -0.05% | -0.15% | 0.17% | -0.47% | 0.05% | 0.21% | -0.10% | |

| Indian rupee | -0.27% | -0.36% | -0.04% | -0.64% | -0.17% | -0.21% | -0.32% | |

| Swiss franc | 0.05% | -0.05% | 0.27% | -0.36% | 0.15% | 0.10% | 0.32% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

The Federal Reserve is expected to cut interest rates next week

- The Indian rupee remains under pressure against the US dollar, even as the latter trades cautiously amid strong expectations that the Federal Reserve (US central bank) will cut interest rates in its monetary policy announcement on December 10.

- At press time, the US Dollar Index (DXY), which tracks the value of the dollar against six major currencies, is trading near a two-week low around 99.40.

- According to the CME FedWatch tool, the probability that the Fed will cut interest rates by 25 basis points to 3.50%-3.75% in December is 87.4%.

- Dovish speculation from the Fed intensified last week after New York Fed President John Williams backed the need for another interest rate cut in December, citing labor market risks. “I see monetary policy as modestly constrained, although somewhat less so than before our recent actions,” Williams said, adding that there is room for further adjustment in the near term.

- Meanwhile, growing expectations among investors that White House economic adviser Kevin Hassett may be chosen to replace Chairman Jerome Powell have dampened the outlook for the US dollar and bond yields. Over the weekend, Hassett said in an interview on Fox News that he would be happy to be chosen as the next Fed chair.

- The choice of White House economic advisor Hassett will not be in favor of the US dollar, assuming that his decisions will be influenced by the economic agenda of US President Donald Trump. “Hassett will be seen as less independent, creating some risks to the dollar as well as risks to the steeper Treasury yield curve,” analysts at Fassett said.

- In Monday’s session, investors will focus on the US Manufacturing Purchasing Managers’ Index (PMI) data for November, which will be published at 15:00 GMT. The agency is expected to announce that the manufacturing PMI contracted at a faster pace to 48.6 from 48.7 in October.

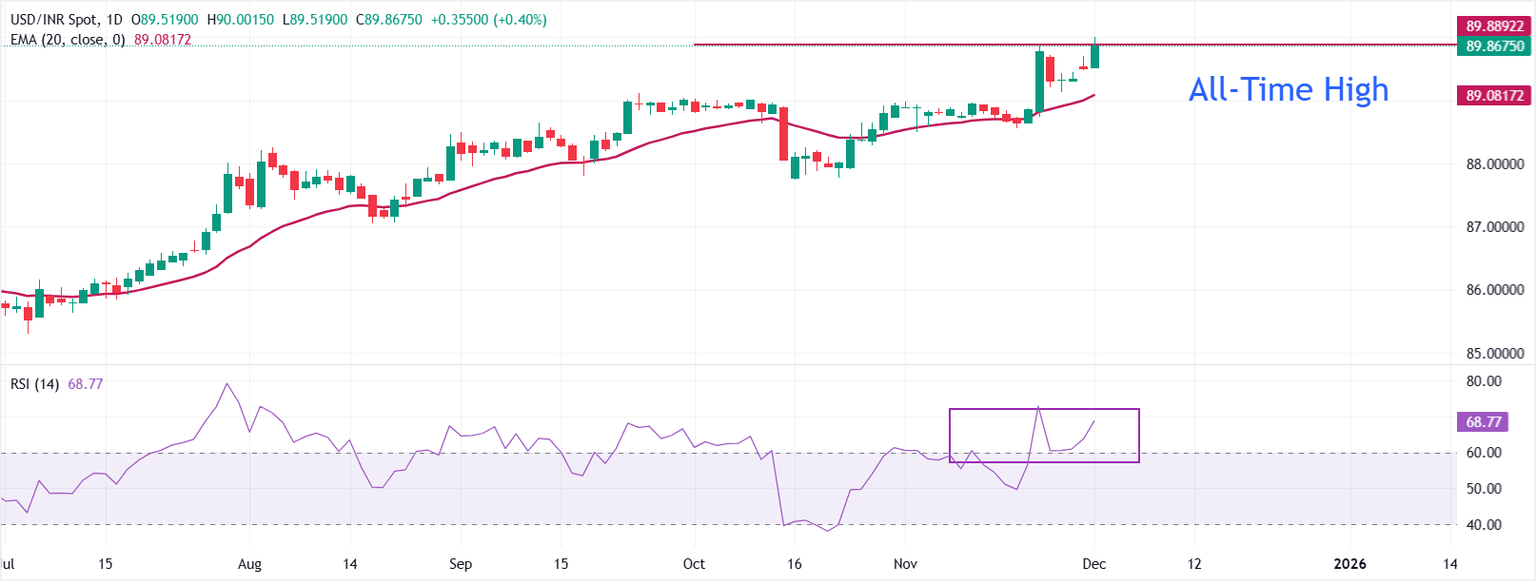

Technical Analysis: USD/INR enters uncharted territory

On Monday, USD/INR hit a new all-time high near 90.00. The 20-day Exponential Moving Average (EMA) is rising and is at 89.0823, keeping the pair biased to the upside with the price holding above it. Declines can be contained by this dynamic support. The RSI at 68.85, near the overbought zone, confirms the strong upward momentum.

Trend-following conditions remain intact as the pair may enter uncharted territory once the psychological level of 90.00 is broken, a move that could lead the pair towards 91.00. On the downside, there are good chances of a corrective move appearing, which could push the pair down towards the lowest level recorded on November 25 at 89.14.

(Technical analysis of this story was written with the help of an artificial intelligence tool)