The Indian Rupee (INR) traded marginally higher against the US Dollar in the opening session on Wednesday. The USD/INR pair fell to around 90.40 as the Indian rupee strengthened on the outcome of US-India trade talks on Tuesday.

India’s External Affairs Minister Subramaniam Jaishankar said in a post on X, formerly known as Twitter, that trade discussions with US Secretary of State Marco Rubio have been good and will continue to discuss the issues. “Just concluded a good conversation with @SecRubio. We discussed trade, critical minerals, nuclear cooperation, defense and energy. We agreed to stay in touch on these and other issues,” Jaishankar posted.

In response, the US Ambassador to India, Sergio Gore, said in a post on X that this was a “positive call” and it was very likely that the next meeting would be held in February.

Easing trade frictions between the US and India is favorable for the Indian rupee, which turned out to be Asia’s worst-performing currency in 2025 due to steep tariffs imposed by Washington on imports from New Delhi. The United States raised customs tariffs on India to 50%, and added punitive tariffs of 25% on the purchase of oil from Russia.

Meanwhile, foreign investors continue to offload their stake in the Indian stock market amid the trade stalemate between the US and India. So far in January, foreign institutional investors (FIIs) have remained net sellers in eight out of nine trading days, offloading their stake worth Rs. Rs 16,925.03 crore.

Meanwhile, India’s PPI inflation data for December returned to the black, rising by 0.83% at an annual pace. Wholesale inflation fell to 0.31% in November, while it was expected to be positive at 0.3%.

The table below shows the percentage change in the Indian Rupee (INR) against the major currencies listed today. The Indian rupee was the strongest against the US dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | Indian rupee | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | -0.03% | -0.12% | 0.03% | 0.00% | -0.28% | -0.14% | -0.03% | |

| euro | 0.03% | -0.10% | 0.06% | 0.06% | -0.26% | -0.11% | 0.02% | |

| GBP | 0.12% | 0.10% | 0.17% | 0.14% | -0.16% | -0.04% | 0.11% | |

| JPY | -0.03% | -0.06% | -0.17% | -0.02% | -0.31% | -0.14% | -0.04% | |

| Canadian | -0.00% | -0.06% | -0.14% | 0.02% | -0.29% | -0.13% | -0.02% | |

| Australian dollar | 0.28% | 0.26% | 0.16% | 0.31% | 0.29% | 0.16% | 0.27% | |

| Indian rupee | 0.14% | 0.11% | 0.04% | 0.14% | 0.13% | -0.16% | 0.12% | |

| Swiss franc | 0.03% | -0.02% | -0.11% | 0.04% | 0.02% | -0.27% | -0.12% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily summary of market drivers: Investors await US Producer Price Index and retail sales data

- The Indian rupee is rising against the US dollar, even as the latter trades strongly against its other peers, following the release of US CPI data for December. At press time, the US Dollar Index (DXY), which tracks the value of the dollar against six major currencies, is holding its gains near a monthly high around 99.25.

- The US Bureau of Labor Statistics (BLS) showed on Tuesday that inflationary pressures remained steady, keeping hopes of the Federal Reserve keeping interest rates at current levels intact. On an annual basis, the headline and core CPI in the United States were 2.7% and 2.6%, respectively.

- Richmond Fed President Tom Barkin called December inflation data “encouraging,” adding that he expects price pressures to remain at modest levels in the next two months, Reuters reported.

- US President Donald Trump welcomed steady inflation numbers and expanded his power over Federal Reserve Chairman Jerome Powell to cut interest rates further. We have a very low inflation rate. “This would give Powell the opportunity to give us a nice, big interest rate cut,” Trump told reporters in Detroit.

- Meanwhile, the Fed’s Powell faces criminal charges over cost overruns in the renovation of the Fed’s headquarters in Washington, which he called an “excuse” for not making monetary decisions in accordance with the president’s preferences. This event raised concerns about the independence of the Federal Reserve.

- In response, global central bank heads showed their support for Fed Chairman Powell, noting that “the independence of central banks is the cornerstone of price, financial and economic stability for the benefit of the citizens we serve.”

- In Wednesday’s session, investors will focus on US Producer Price Index data for October and November, and November retail sales data, which will be published at 13:30 GMT.

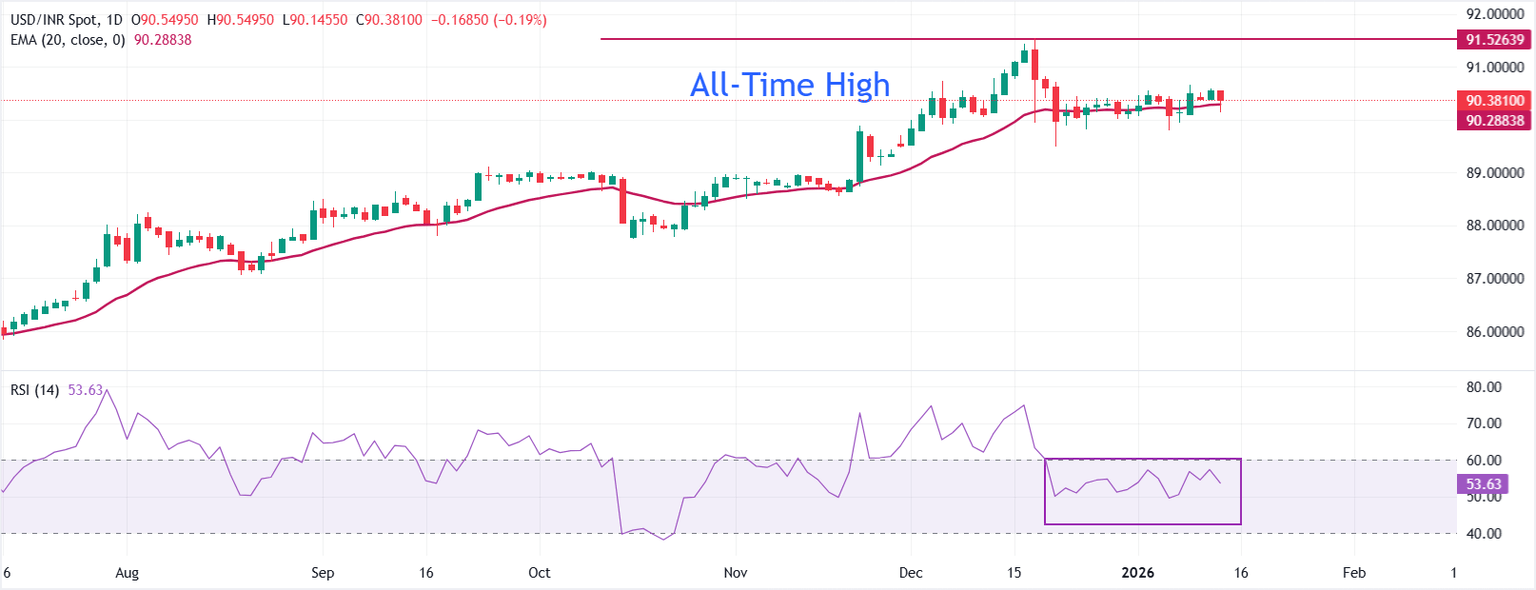

Technical Analysis: USD/INR is consolidating while the RSI (14) remains within the 40-60 range

USD/INR is trading lower around 90.3810 as of writing. The price is holding above the 20-day exponential moving average (EMA) at 90.29, maintaining a short-term bullish bias. The 20-day EMA is trending higher, supporting the path of least resistance to the upside.

The 14-day Relative Strength Index (RSI) at 53 (neutral) has eased from previous readings, confirming moderate momentum.

As long as the pair remains above the bullish 20-day EMA, the bias remains positive and declines remain supported, while a daily close below this measure could open the way for a deeper correction. An RSI hovering near the midline indicates balanced conditions; Further fading in momentum would favor consolidation, while a recovery could support an extension of the advance.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Economic indicator

WPI inflation

WPI inflation index issued by Ministry of Trade and Industry It is a measure of price movements similar to the Consumer Price Index (CPI). In general, a high reading is considered positive (or bullish) for the rupee, while a low reading is considered negative (or bearish).

Read more.

Latest version:

Wednesday 14 January 2026 at 06:30

repetition:

monthly

actual:

0.83%

consensus:

0.3%

former:

-0.32%