The USD/JPY pair is trading in a narrow range around 158.50 during the Asian trading session on Thursday. The pair is consolidating as an upbeat US Dollar (USD) offset a decent recovery in the Japanese Yen (JPY).

Japanese yen price today

The table below shows how much the Japanese Yen (JPY) has changed against the major currencies listed today. The Japanese yen was the strongest against the New Zealand dollar.

| US dollars | euro | GBP | JPY | Canadian | Australian dollar | New Zealand dollar | Swiss franc | |

|---|---|---|---|---|---|---|---|---|

| US dollars | 0.05% | 0.05% | -0.05% | 0.10% | 0.19% | 0.23% | 0.03% | |

| euro | -0.05% | -0.00% | -0.11% | 0.05% | 0.13% | 0.18% | -0.02% | |

| GBP | -0.05% | 0.00% | -0.11% | 0.05% | 0.14% | 0.18% | -0.02% | |

| JPY | 0.05% | 0.11% | 0.11% | 0.13% | 0.23% | 0.25% | 0.08% | |

| Canadian | -0.10% | -0.05% | -0.05% | -0.13% | 0.10% | 0.13% | -0.06% | |

| Australian dollar | -0.19% | -0.13% | -0.14% | -0.23% | -0.10% | 0.05% | -0.15% | |

| New Zealand dollar | -0.23% | -0.18% | -0.18% | -0.25% | -0.13% | -0.05% | -0.20% | |

| Swiss franc | -0.03% | 0.02% | 0.02% | -0.08% | 0.06% | 0.15% | 0.20% |

The heat map shows the percentage changes in major currencies versus each other. The base currency is chosen from the left column, while the counter currency is chosen from the top row. For example, if you select the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent the Japanese Yen (base)/US Dollar (quote).

The Japanese currency rose after remaining pessimistic in the past few weeks amid fears of intervention. Japanese Chief Cabinet Secretary Seiji Kihara said on Wednesday that the government may intervene due to excessive one-way moves against the Japanese yen.

However, the recovery movement in the Japanese currency is expected to remain limited, with Prime Minister Sanae Takaishi’s trade remaining in a state of momentum.

Market experts expect Takaichi to win the early early elections, which are expected to be announced next week after the dissolution of the lower house of parliament, Reuters reported. A win for Takaishi will help it gain support for his budget, which is expected to be equipped with higher spending plans, a favorable event for Japanese stock markets and a reflection of the currency trend.

Meanwhile, the US Dollar Index (DXY) is holding gains near a monthly high of 99.26 amid expectations that the Federal Reserve (Fed) will leave interest rates unchanged at its policy meeting later this month.

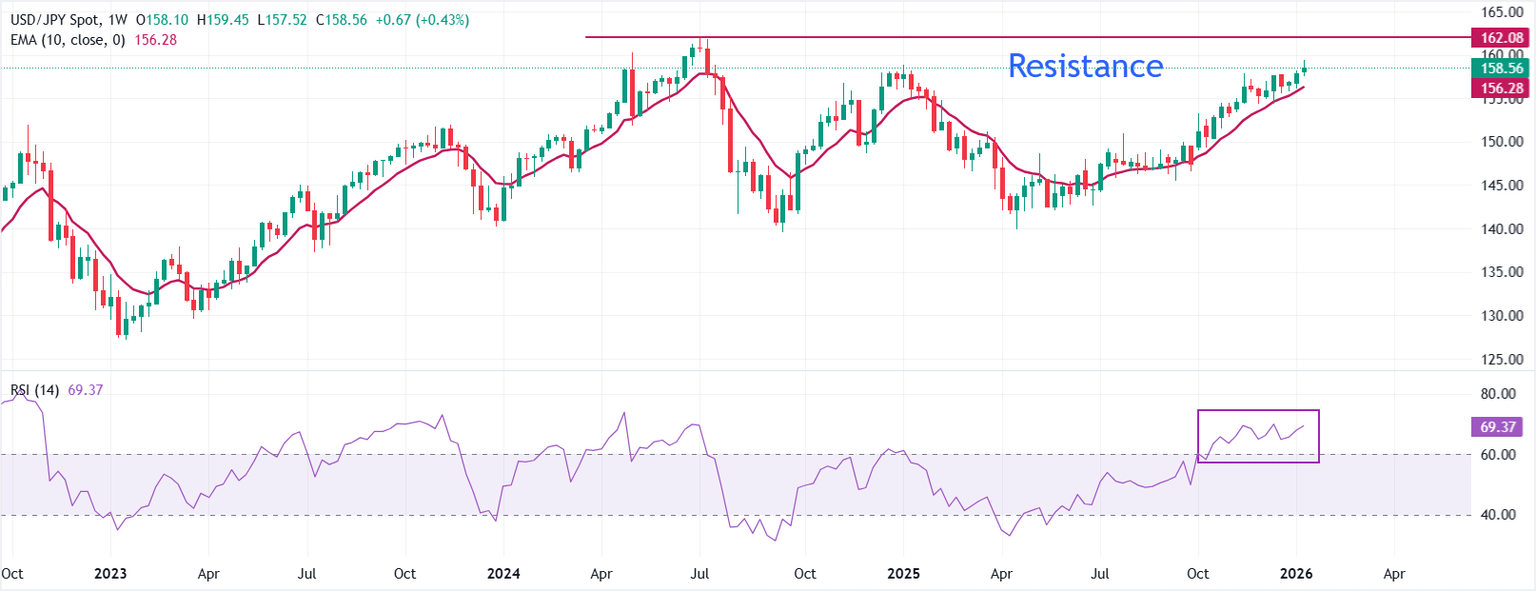

Technical analysis of the USD/JPY pair

The USD/JPY pair is trading almost flat at around 158.56 at press time. The price is holding well above the bullish 10-week Exponential Moving Average (EMA), reinforcing a strong uptrend. The continued rise of the 10-week EMA supports the declines and maintains pressure on the upside.

The 14-week Relative Strength Index (RSI) at 69.37, near overbought territory, confirms strong momentum but indicates extended conditions. Initial support stands at the 10-week EMA at 156.28.

While above the EMA trend, advances could be extended, with setbacks expected to be contained by dynamic support. A short pullback would help cool the RSI from overbought territory and sustain the broader move. A weekly close below 156.28 would weaken the bullish structure and open the way for a deeper bounce.

(The technical analysis for this story was written with the help of an artificial intelligence tool.)

Frequently asked questions about the Japanese Yen

The Japanese Yen (JPY) is one of the most widely traded currencies in the world. Their value is determined broadly by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the spread between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the powers of the Bank of Japan is to control the currency, so its movements are key to the yen. The Bank of Japan has intervened directly in currency markets on occasion, generally to devalue the yen, although it often refrains from doing so due to the political concerns of its major trading partners. The Bank of Japan’s ultra-loose monetary policy between 2013 and 2024 caused the yen to depreciate against its major counterparts due to the growing policy divergence between the Bank of Japan and other major central banks. More recently, the gradual dismantling of this ultra-lenient policy has given the yen some support.

Over the past decade, the Bank of Japan’s ultra-loose monetary policy stance has led to widening policy divergence with other central banks, especially the US Federal Reserve. This supported the widening of the spread between the US and Japanese 10-year bonds, which favored the US dollar against the Japanese yen. The Bank of Japan’s decision in 2024 to gradually abandon ultra-loose policy, along with interest rate cuts at other major central banks, are narrowing this spread.

The Japanese yen is often viewed as a safe investment. This means that in times of market stress, investors are more likely to put their money into the Japanese currency because of its supposed reliability and stability. Turbulent times are likely to strengthen the value of the yen against other currencies that are considered riskier to invest in.